From Alibaba to Tencent, Chinese companies buying up the world

Huge Chinese businesses spending big bucks overseas

China's interest in owning global businesses goes back to 1999 when it introduced its Go Out Policy, which gave financial incentives to invest overseas. And after the 2008 financial crisis many struggling businesses around the world turned to Chinese investors in order to survive. Now that the coronavirus pandemic has driven many of the world's countries into recession, some nations have aired concerns about overseas ownership of domestic companies, fearing that Chinese state-owned and state-linked enterprises could exploit the forthcoming economic crisis. As relations between Western countries and China have been strained of late, notably because of the US-China trade war and China's actions in Hong Kong, these worries have become even more pronounced. Click or scroll through to find out more about China's moves into Western countries and companies over the years. All dollar values in US dollars.

Italian fashion industry owned by Chinese businesses

Over the last two decades, Italy's fashion capital Prato, in Tuscany, has been transformed from a traditional textile manufacturing hub to a fast-fashion town with at least 4,000 Chinese-run clothing factories. The companies, eager to exploit the desirable 'Made in Italy' label, moved into the area in droves, sparking clashes with locals over jobs. Even though the Chinese investment boosted the market for Italian clothes exported to China, as well as to Europe, due to lower costs, by outsourcing materials and paying their workers less, many of these companies have undercut local businesses and left them unable to compete.

ICBC bought a stake in South Africa's Standard Bank

Sponsored Content

Chinalco bought a stake in mining giant Rio Tinto

COSCO invested in Greek port Piraeus

Beijing Automotive Group has stakes in multiple international car businesses

Driven by the Chinese government's Go Out international expansion policy, state-owned Beijing Automotive Group (BAIC) snapped up Saab intellectual property in 2009, and has undertaken joint ventures with Mercedes-Benz and Hyundai. It has also built the world's largest Chinese parts factory in South Africa. BAIC already has a 5% stake in Mercedes-Benz parent company Daimler, but in late 2019 it was reported to be buying more shares in the company on the open market as part of a plan to increase its stake to 10%.

Sponsored Content

China Minmetals owns OZ Minerals in Australia

China's state-controlled metals and mineral trading company China Minmetals has a strong global presence and has a North American HQ in Weehawken, New Jersey. The company also owns the lion's share of Australian mining company OZ Minerals, which it acquired back in 2009, as well as Congo-focused copper producer Anvil Mining.

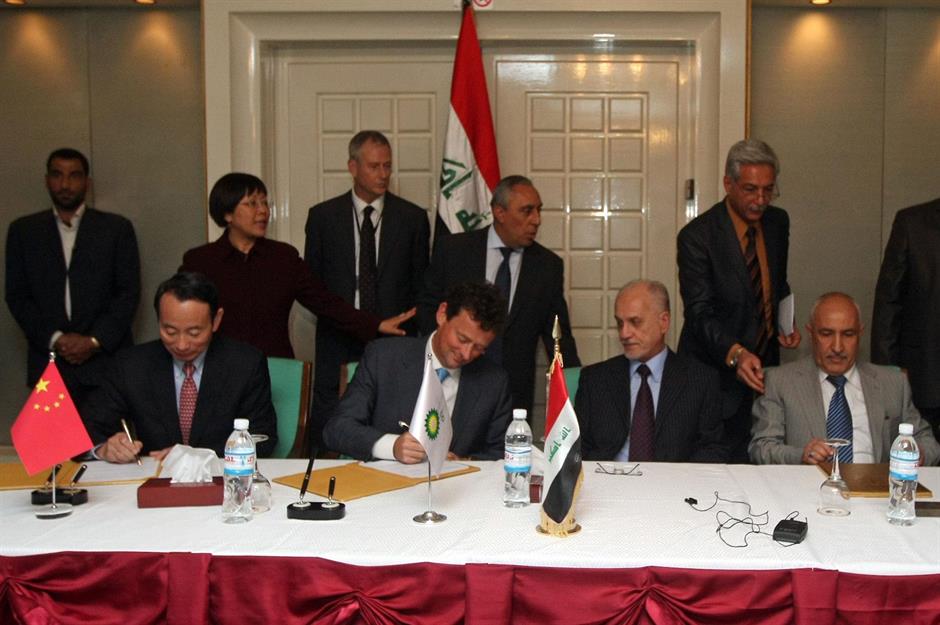

CNPC bought a stake in Iraq's Rumaila oilfield

Sinopec bought Swiss-owned oil company Addax Petroleum

Sponsored Content

Sinopec also bought a stake in Spanish energy company Repsol's Brazilian unit

Swedish car company Volvo acquired by China's Zhejiang Geely Holding Group

In 2010, Swedish motor company Volvo, previously owned by Ford, was sold to Chinese automaker Zhejiang Geely Holding Group for $1.3 billion (£1bn). The move was seen as part of a wider movement in the auto industry where Chinese companies buy up major brands, including MG, for which there was a bidding war between Chinese automakers Nanjing Automobile Group and SAIC in 2006. Nanjing was initially successful, but SAIC didn't give up and bought Nanjing in 2007. Similarly Lotus has a majority Chinese owner, with Zhejiang Geely Holding Group taking a 51% stake in the business in 2017.

Major American movie theatres now Chinese-owned

In 2012, Chinese multinational conglomerate Dalian Wanda Group acquired iconic US cinema chain AMC Theaters for $2.6 billion (£2bn), before purchasing another US cinema chain, Carmike Cinemas, for $1.1 billion (£876m) in 2016. The two companies together represent the largest theatre group in the US. In the same year Dalian Wanda also tried to buy US production company Dick Clark Productions for $1 billion (£797m), although the sale was terminated after Wanda failed to honour its contractual obligations.

Sponsored Content

CNOOC bought Canadian oil and gas company Nexen

Chinese companies making inroads into the US pork industry

By the end of 2012 Chinese businesses owned $900 million (£717m) of US farmland, up 1,000% on the previous year. And China's influence in America's agriculture industry grew in 2013. One of the world's largest pork producers, Smithfield Group, was bought by meat processing company Shuanghui Group, now called WH Group. The sale was valued at $7.1 billion (£5.6bn) and it meant that one in four pigs in the US is now owned by a Chinese company.

London's black taxis are Chinese-owned

Sponsored Content

CNPC bought a stake in a Kazakhstani oil and gas company

China Minmetals, Suzhou Guoxin and CITIC bought Peru's Las Bambas copper mine

China Life Insurance Company has bought up foreign real estate

Sponsored Content

ChemChina and SAFE bought Italian tyre company Pirelli

Famed for its quality tyres and arty calendars, Italy's Pirelli was acquired in June 2015 for $7.9 billion (£6.3bn) by a consortium led by agrochemicals and rubber manufacturer ChemChina. Two years later, the Chinese firm relinquished control of the Italian tyre-maker, selling off part of its original 65% stake, and returning Pirelli to the Milan stock exchange in a move designed to give the company a "market friendly face" and appeal to European investors. ChemChina now has a 45.5% stake in the business.

CGN bought Malaysian energy company Edra

Anbang bought American company Strategic Hotels & Resorts... but wants to sell it

After buying New York's Waldorf Astoria Hotel for $2 billion (£1.6bn) from private equity firm Blackstone in 2014, Chinese insurance titan Anbang bagged America's Strategic Hotels & Resorts in March 2016, stumping up $5.7 billion (£4.6bn). However, in 2018 the conglomerate was seized by the Chinese government after its former chairman was arrested and then jailed for fraud. After raising money by selling many of its portfolio of trophy hotels, including America's Strategic Hotels & Resorts to Korea's Mirae Asset Management, Anbang was released by the Chinese government in February this year. However, it is now facing a legal battle with Mirae after the $5.8 billion (£4.6bn) deal for Strategic Hotels & Resorts hasn't been paid as the pandemic has impacted financing.

Sponsored Content

HNA bought Irish aircraft leasing company Avolon

Chinese conglomerate HNA, whose interests span sectors including aviation, financial services and tourism, spent as much as $50 billion (£40bn) on buying various foreign firms during 2016 and 2017. One of the most notable purchases was of Irish aircraft leasing company Avolon via its subsidiary Bohai Leasing. The deal was finalised at $5.2 billion (£4.2bn) in January 2016.

Chinese firm takes over American appliance manufacturer

HNA bought American company CIT Group's aircraft leasing business

Sponsored Content

ChemChina and China Reform Holdings bought Swiss agrochemicals and seed company Syngenta

ChemChina teamed up with the Chinese government's sovereign fund China Reform Holdings in June 2017 to buy Swiss agrochemicals and seeds company Syngenta for $43 billion (£34.5bn). In January 2020 ChemChina revealed a plan to consolidate all its agricultural assets into a new holding company to be called Syngenta Group, which will be based in Basel, Switzerland. Reuters reported that ChemChina has approached Chinese backers for $10 billion (£7.9bn) to fund the reorganisation, ahead of taking the group public.

CIC bought pan-European warehouse company Logicor

Vanke, Hopu, Hillhouse and Bank of China bought a major stake in Singaporean warehouse company GLP

Sponsored Content

China Southern Power has energy stakes around the world

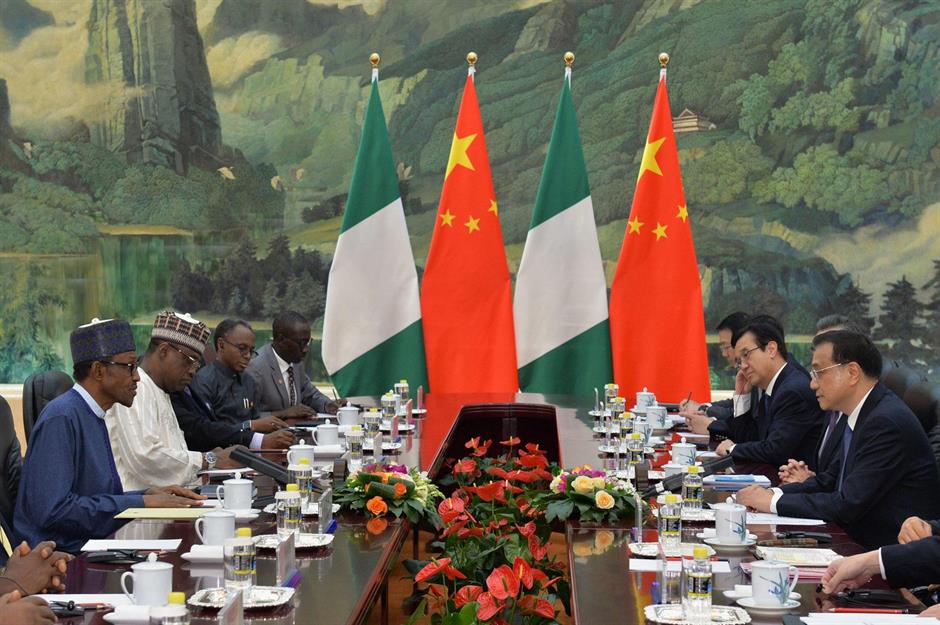

CEEC, PowerChina and Sinopec's invested in Nigeria's Mambilla Power Station

In December 2018, a consortium of Chinese companies, made up of China Energy Engineering Corporation (CEEC), PowerChina and Sinopec, invested $5.8 billion (£4.6bn) in a power plant in Nigeria. The hydroelectric plant is one of the largest project of its kind on the African continent and stands as evidence of ongoing Chinese interest in overseas energy projects.

Alibaba buys German big data start-up Data Artisans

In January last year, online shopping giant Alibaba purchased a German data company, Data Artisans, for €90 million ($103m/£60m). The little-known start-up specialises in providing large-scale data streaming services for businesses and was founded just six years ago. The deal marks an expansion for Alibaba into the data processing sector.

Sponsored Content

Huawei bought Russian security firm worth $50m in June last year

Controversial tech giant Huawei has hardly been out of the news lately, whether that’s for 5G technology or government bans of its services. In June last year, the company acquired Moscow-based security firm Vokord for $50 million (£40m). Huawei is said to be interested in the company’s facial recognition software, as well as its technical patents.

Find out the story behind controversial Chinese company Huawei

China Development Bank Leasing acquires LNG vessel

In December last year, China Development Bank paid $154.5 million (£123m) for an LNG vessel used to transport liquefied natural gas. The purchase indicates a move towards increased investment in natural gas. It was recently reported by Reuters that China is expected to increase its natural gas consumption by 5% in 2020, and China’s top energy companies are increasing their natural gas output accordingly.

Major Chinese engineering company buys Spanish engineering firms

Moving now into this year's purchases, which some have linked to the coronavirus pandemic and Chinese companies attempting to make the most of the economic fallout from COVID-19. On 21 January, China Energy Engineering Group acquired Spain's EAI and GHESA, the largest purchase of Spanish engineering companies by Chinese firms so far. This follows an increase of Chinese investment in Spain by 800% between 2014 and 2018. EAI is a company focused on energy, renewables and information, while GHESA works on infrastructure construction and power facilities.

Sponsored Content

Chinese state-owned engineering company buys stake in first European firm

China State Grid Corporation buys Oman electricity company

In March it was reported that the State Grid Corporation of China (SGCC) had completed a 49% acquisition of Oman Electricity Transmission Company. The SGCC is one of the largest public utilities in the world and has acquired significant stakes in electricity companies in the Philippines, Portugal, Australia, Hong Kong, Italy, Brazil and Greece since 2008.

China Mobile bought a 20% stake in AsiaInfo

In April, China Mobile bought a 20% stake in AsiaInfo Technologies, which will see the two companies enter into a strategic partnership for developing 5G, network intelligence and digital operations, among other things. The purchase has been valued at $180.6 million (£144m).

Now read about the industries that will boom after the coronavirus pandemic

Sponsored Content

Tencent buying stakes in large gaming companies

Tencent, a Chinese multinational corporation which specialises in technology and internet services, has capitalised on an increased demand for video games during lockdown. The company spent $260 million (£208m) on a majority stake in Czech-based games designer Bohemia Interactive in late May, one week after it purchased a 20% stake worth $65 million (£52m) in Japanese gaming firm Marvelous. This is not Tencent's first foray into gaming. In 2016 it was part of the consortium that bought an 84.3% stake in Finland's Supercell, of which Tencent received a 50% share. In 2019, Tencent increased its ownership of Supercell to 51.2%. Tencent also has stakes in Snapchat, Spotify, Tesla, and Hollywood movie studios.

Chinese government buys stake in Norwegian Air

Airlines haven’t exactly had an easy time of it lately and Norwegian Air needed to restructure its debt before being entitled to government support. That’s where investors including BOC Aviation came in, purchasing a 12.67% stake in Norwegian Air in May. Singapore-headquartered, BOC Aviation is 70% owned by Sky Splendour Limited, which is a subsidiary of the Bank of China.

Chinese railway firm buys majority stake in Spanish engineering company

On 23 May, it was reported that China Railway Construction Corporation, the second largest company in the Chinese construction sector, had bought a 75% stake in Aldesa Group, a Spanish engineering company.

Sponsored Content

Zijin Mining acquires Guyana Goldfields

In a significant deal that was announced in June, Chinese mining company Zijin Mining Group bought Canadian mining company Guyana Goldfields, which owns the Aurora gold mine in Guyana, South America, for CA$323 million ($238m/£190m). This follows Zijin Mining's purchase of Continental Gold for CA$1.3 billion ($960m/£763m) in March and a 50.1% stake in two copper mines in Tibet in early June.

Now read about businesses fast-forwarding plans because of COVID-19

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature