Sell Premium Bonds: best and easiest ways to cash them in and withdraw your money

Want to cash in and withdraw your Premium Bonds? Here are the best and easiest ways to sell up and get your money back from NS&I.

Sections

How to cash in NS&I Premium Bonds online

The easiest way to sell or cash in your NS&I Premium Bonds is by logging into your account online, as this is available 24 hours a day.

If you applied for the bonds online, then you’re already registered so all you'll need is to have your details to hand.

These will include your NS&I number and the password that you'll have set up.

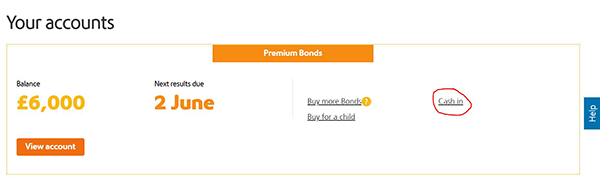

Once logged into your account, you should see an option to 'cash in' your Premium Bonds on the right-hand side of the screen. We've circled it on the screengrab below.

From there, you'll be asked to choose whether you want to cash in your oldest bonds first or not, then choose whether you’d like to defer your payment until the next prize draw.

That option would obviously mean you'd have to wait until early next month to get your money back. If you opt to get it now, NS&I says the money will arrive in your nominated bank account within three working days, but it usually happens a little sooner.

Again, if you've already purchased your bonds online, your bank details should already be in the system, so you won't need to do anything else.

Want more stories like this? Visit the loveMONEY homepage or sign up for our daily newsletter and let us send the news to you!

How to cash in NS&I Premium Bonds by phone

If you don't like the online option, you can easily cash in your NS&I Premium Bonds through the NS&I phone service.

If you applied for the bonds by phone, then you’re already registered. Simply call 08085 007 007.

Make sure you have your NS&I number and password to hand. This should only take a few minutes.

Want more stories like this? Visit the loveMONEY homepage or sign up for our daily newsletter and let us send the news to you!

Filling out the Premium Bonds Cash In form

If you didn’t apply for your Premium Bonds online or by phone, you can withdraw your money by filling out the Premium Bonds Cash In form.

Simply select how many bonds you want to cash in by ticking the relevant box in section three of the form.

If you want to cash in a specific set of your Bond numbers, simply enter the first Premium Bond number from each range.

If you tick ‘No’ in section four or leave it blank, NS&I will cash in your oldest bonds first.

How will I be paid for my Premium Bonds?

Section six of the form is where you decide how you want your Premium Bonds to be paid out.

You can choose from a direct credit into your current account or by warrant, which is like a cheque, through the post.

NS&I says it normally takes up to eight working days from the point of receiving your application to process your request (unless you opted to defer the payment until after the next prize draw).

If you don’t have your funds by then, get in touch with NS&I – ideally by calling 08085 007 007 as tweeting and emailing can involve security risks. Find out more about contacting NS&I here.

Not sure where to put your savings once you've cashed in your bonds? Take a look at our comprehensive roundup of where to get the best rate on your money.

Best time to sell your Premium Bonds

If you don't have to sell your bonds immediately, it's worth thinking about the right time to ditch some or all of your holdings.

It may be worth waiting until the start of a new calendar month to do so rather than, say, the last week of the month.

This way you can ensure your holdings will have one final chance to win big in the monthly draw before you withdraw them.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature