Opinion: Premium Bond prize rate hike? Not going to happen

Despite the spate of Base Rate hikes, an increase to the Premium Bond prize rate looks even less likely. Here’s why.

It feels like everything is rising at the minute.

The Base Rate has been hiked three times since December, mortgages are getting pricier, energy bills are about to jump another 50%, Council Tax is on the rise as usual, and you may have noticed a slight change at the pumps in recent months…

When you look at the above list, it’s not hard to see why the Office for Budget Responsibility has warned that we're in for the biggest squeeze on real incomes since records began – and that’s despite yesterday’s Spring Statement giveaways.

But, unfortunately for savers, one thing that isn’t likely to join the burgeoning list of hikes is the Premium Bond prize rate.

Here’s why.

Hang on, isn’t Base Rate rising?

As a general rule, an increase in the Base Rate spells good news for savers as it means savings rates rise along with it.

So you’d think three Base Rate hikes in a matter of months, from 0.15% to 0.75%, would result in a relative bonanza for the savings market.

But it just hasn’t happened this time around, because banks frankly don’t need our savings right now.

As Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, explained in the build-up to the most recent rate hike earlier this month.

“Savers have every right to feel disappointed, because savings rates have barely budged since the Bank of England started raising interest rates.

“Over the past two years, savers have been moving their cash back to the big high street banks.

“In an uncertain world, they’ve felt more comfortable with brands they have known for life than newer banks available online.

“With so much cash washing around in the big high street banks, they don’t need to offer decent savings rates, and can stick with cheap mortgage deals.

“They’re essentially operating as if rates haven’t really risen.”

Why NS&I won’t hike Premium Bonds

That explains why traditional savings rates aren’t rising, but what about Premium Bonds?

These are influenced by slightly different pressures because they are offered by the state-backed NS&I.

NS&I will set its rates based on how much money it needs to attract to meet its annual funding targets.

If it’s bringing in too much money then rates will fall, while a lack of incoming funds will generally equal rate hikes.

Since late 2021, we have been writing regularly about the fact that NS&I was lagging massively behind this financial year’s target, which is set at £6 billion (within a range of between £3 billion and £9 billion).

In short, it had attracted just £600 million in the first six months of the year, and in response, it started hiking rates on a bunch of its less popular savings products.

It wasn’t initially clear just how effective those hikes were proving, and we recently wondered whether NS&I would get sufficiently desperate to push the big red button marked ‘Premium Bond rate hike’ as the year-end deadline loomed ever closer.

Today we received our answer and, sadly, it’s a resounding ‘no’.

Providing its Net Financing update, NS&I revealed it was forecast to finish 2021/2022 with net in-flows of £4 billion, having raked in £1.6 billion in the third quarter alone.

Remember, anything over £3 billion keeps it within range of its target, meaning it has no need to hike rates any further – at least not in this financial year.

What will it take for a Premium Bond hike?

You might be wondering what needs to happen for the Premium Bond prize rate to rise.

The most likely answer is that NS&I has to fall sufficiently behind on next year’s funding target that it feels compelled to hike its headline product rather than just the supporting acts.

And for that to happen, we need to see ‘traditional’ savings rates rising well beyond their current levels.

We know that traditional savings work differently, but the fact remains that new savers will dodge Premium Bonds if there are far better rates on offer elsewhere.

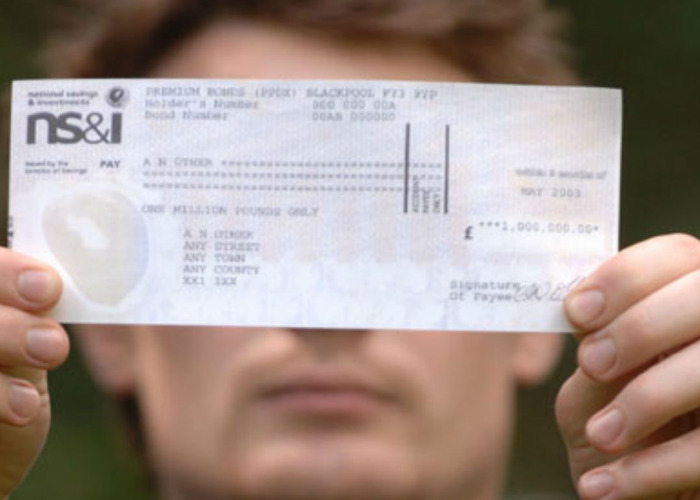

The chance to win £1 million can only hold so much sway, after all.

Savings rates must rise

At present, the best access savings accounts – the ones that are most comparable to Premium Bonds – pay up to 0.9%.

Given the Premium Bonds prize rate is currently 1%, they remain extremely attractive compared to high street rivals.

However, this could change as further Base Rate hikes are rolled out. Some analysts expect it to reach 1.25% this year and 2% in 2023.

While there’s no guarantee that all, or even most, of that will be passed on to the savings market, it would be hard to imagine a situation where the best access accounts don’t pay somewhere near the Base Rate.

Against that yardstick, a 1% Premium Bond rate might finally start to look less appealing.

Now, that’s obviously nothing more than a guess. The one thing that seems far more likely is that Premium Bonds won’t be rising any time soon.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature