loveMONEY comment: we must act NOW to avoid financial disaster

Many households are unaware and unprepared for the staggering bill hikes coming this winter – but there is still time to protect our finances.

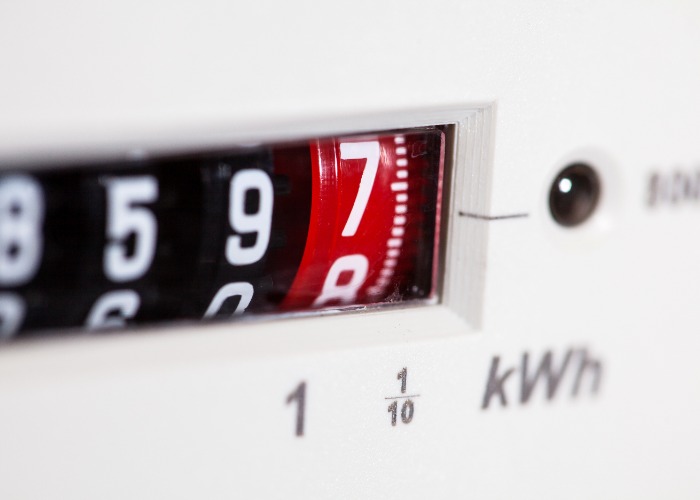

The new energy price cap has been confirmed, rising almost £1,600 to £3,549 a year in October.

This will undoubtedly have a huge impact on households, many of whom are already struggling to cope.

But the size of the financial tidal wave we’re facing is actually far bigger than the latest price cap hike alone.

The good news is that it is possible to offset at least part, if not all, of the devastation provided you’re willing to act without delay.

Small steps taken now – and repeatedly in the coming months – can have a huge impact on your finances and leave you in a far stronger position when bills start skyrocketing.

Struggling to pay energy bills? Visit Citizen’s Advice for help

Soaring bills and limited funds could lead to catastrophe

We absolutely don’t want to scaremonger, but there’s no point ignoring the threat many households are facing in the coming six months to a year.

First, it seems that many of us are underestimating the scale of the impending price hikes.

A survey by price comparison site uSwitch found households typically think the price cap is rising by around £500 rather than the actual £1,600 hike.

That means many could be lulled into a false sense of security.

Second, it’s important to understand that the £3,549 ‘cap’ on energy bills coming in October is not the maximum you can pay for your energy in a year.

The cap applies to the maximum amount energy companies can charge per unit of energy, and the aforementioned figure is merely what the typical household can expect to pay.

If your household uses especially high amounts of energy – perhaps you live in a large, draughty home – then your bill will be far higher.

Find out what energy and insulation help the Government can offer you

To give you an idea of what to expect, October’s energy price cap is 178% higher than the same time last year.

Unless you’re on a fixed-rate deal that’ll run through the winter, that’s how much you can expect your bills to rise by.

Of course, you might face even greater hikes compared to a year ago if you were on one of the reduced/fixed tariffs that were available back then.

And it gets worse: Ofgem recently announced the price cap will be revised every three months instead of six.

Most analysts believe it will rise sharply once more at the start of January, meaning the second half of the high usage months will be even pricier.

So it seems likely households will have to find hundreds of pounds extra a month to meet their energy bills but, of course, that’s not the only bill that’s soaring.

Food, fuel and mortgage costs are all far greater than they were a year ago, meaning our budgets are already stretched and we have less – if any – spare cash to cover rising bills.

So what’s the solution?

Possible reasons for optimism?

While the above is admittedly a gloomy outlook, we wanted to make sure everyone was clear on the financial threat we face.

Now, we should point out that things could change for the better between now and the end of winter.

For starters, there’s a good chance the Government will announce further help on top of the £400 energy bill contribution it’s already promised.

It wouldn’t be a massive surprise if the new leader of the Conservatives wanted to announce some headline-friendly measures early in their premiership.

Second, it’s possible (though unlikely) that energy cap hikes for January and April are lower than forecast as wholesale energy prices dip unexpectedly.

As we say it’s not likely to happen, but we wanted to highlight any potential reasons for positivity.

Ultimately, both of these factors are out of your control so it’s best to plan as though they’re not happening and if they do come to pass then they’re merely a welcome bonus.

This means taking things into your own hands and offsetting soaring bills - at least partly - by earning some extra cash while cutting costs from your existing budget.

Everyone can take steps to ease the pain

People who subscribe to our newsletter will know that we’ve been writing regularly about the things you can do to shore up your budget during this cost-of-living crisis.

You can’t transform your finances overnight, but you can start making small changes right now and build from there.

On Wednesday, John Fitzsimons highlighted how you can earn an extra £200 this week alone – that could be enough to cover the increase in winter energy bills for one month.

Looking longer term, we’ve put together a ton of ways to earn more money in your spare time as well as 14 ways you can boost your bank balance online.

On top of increasing your income, you should look to spend less. With that in mind, take a look at our in-depth guide to saving on practically everything.

In terms of your energy bills, you should obviously take steps to use less of the stuff – our top tips can be found here.

Finally, it’s worth revisiting money changes that might have seemed like a bad idea in the past.

As we highlight here, if you did the sums on a new boiler a year ago and the savings were minimal, well, the answer might come up very different now that energy is 200% more expensive.

Things will get worse: act now to minimise the impact

The pressure on people's budgets is going to increase dramatically between now and Spring. Households that might not normally worry about making ends meet will soon find themselves in real financial trouble.

By starting now and taking regular steps to shore up our finances over the coming months, many households can help avert this situation.

Be sure to check in regularly with us as we'll be rolling out more tips, tricks and guides throughout this cost-of-living crisis.

Struggling to pay energy bills? Visit Citizen’s Advice for help

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature