Opinion: tax relief on ISAs is too generous and benefits the rich

The Treasury is handing huge amounts in tax reliefs to the wealthiest savers. Is there not a better way to devote that money that will encourage more people to save?

ISAs are a tremendously rewarding way to save.

Everyone in the UK gets a £20,000 standard annual limit – plus an additional £5,000 bonus when the British ISA launches later this year – and enjoy tax-free returns.

The trouble is that not everyone is benefitting equally from them.

A report from the Resolution Foundation has argued that they aren’t really working as an incentive to save.

Instead, the Treasury is handing millions in tax relief each year to the wealthiest, who ‒ chances are ‒ would have saved money anyway, even if those tax reliefs weren’t in place.

Is the money going to the wrong savers?

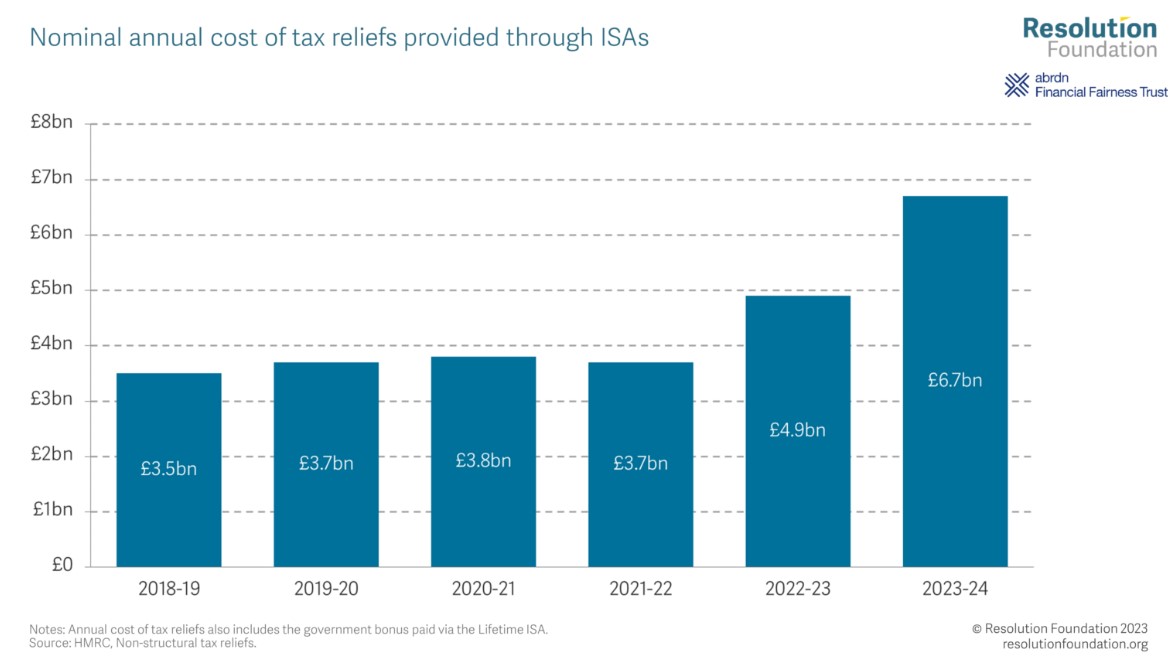

For example, the Resolution Foundation estimates that ISAs cost £6.7 billion in potential tax revenue during the 2023/24 tax year, which is given up as a result of their tax break status.

However, around a third of total ISA savings are held by the richest 10% of families.

The issue isn’t limited solely to ISAs either.

The Government has previously introduced the savings allowance, which sets out how much people can save each year in non-ISAs without paying tax on the interest.

Basic rate taxpayers enjoy a £1,000 allowance, dropping to £500 for higher rate taxpayers and nothing for additional rate taxpayers.

The report found that around 41% of the foregone tax revenue goes to the richest 10th of households.

Adding it all together, households in the richest 10th will get around £800 on average from the Government’s various savings-related measures, while the average household will get £250.

Households in the poorest 10th will receive just £38.

Far from acting as a spur to get households, of all income levels, into the savings habit, these measures are actually working as an added benefit to those who are already most likely to be saving in the first place.

Manage all your savings accounts in one place with Raisin, the simple savings service

The scale of the saving problem

We have had a problem with savings for a long time.

In fact, the report notes that we have had the lowest saving rate out of the G7 nations in four out of every five years dating back to 1980.

In other words, when you compare Britain to rival big nations, we lag behind badly when it comes to building a savings safety net.

To put that into context, around 750,000 households do not have any savings at all, not a penny set aside which they can turn to when times get tough ‒ a boiler breaks, the car needs repairs, etc.

Even those with some level of savings often have insufficient amounts.

The report added that households in the bottom half of the income distribution typically only have around £3,000 in savings per adult.

That’s an awful lot of people who have a very modest level of savings, which would be virtually wiped out by a fairly small shock expense.

Stripping back the tax relief

The argument from Resolution is that the money the Government is spending on tax relief for the wealthy could be put to better use.

Between the various ISAs and schemes like Help to Save, the Treasury is going to be giving up around £7 billion a year ‒ that’s a lot of money potentially going to people who don’t really need it.

So what could that look like? One suggestion is to scale up Help to Save.

The scheme allows some people on Universal Credit or working tax credits to get a bonus of 50p for every £1 they save over a four-year period.

Currently, it is massively underutilised, with very few people who are eligible even knowing it exists.

Resolution suggests that turning it into an auto-enrolment scheme, where people on those benefits are automatically enrolled, would prove effective.

It also calls for the monthly savings cap to be increased from £50 to £100.

To do this, some of the money spent on tax breaks to ISA savers could be stripped back.

This would see the total amount of ISA savings that are tax-free capped at £100,000.

Around 1.5 million people have savings in excess of this cap in ISAs alone, but the cap could raise around £1 billion.

Getting a better balance

My first reaction to the suggestion of ISAs becoming less rewarding was one of concern.

Things are tough enough for all of us to get the most out of our money, and any move that would make savings less attractive is one that I would instinctively be wary of.

However, it’s clear that the balance is off at the moment.

The whole point of the tax-free status for ISAs is to encourage people to save, to offer a real, tangible incentive to put that money aside rather than spend it.

But right now that incentive isn’t quite working for everyone.

The challenges of the last couple of years, from the pandemic to incredible inflation levels that we are battling against now, have emphasised the need to have some level of savings safety net in place.

Yet huge numbers of people don’t have that - and would benefit from a helping hand getting into the savings habit.

In an ideal world, the Treasury would have the cash at hand to keep the existing rewards in place for more well-off savers while also coming up with something that will be more effective in encouraging those with virtually nothing in savings to start saving.

However, that’s simply not feasible ‒ if more money is to go towards helping small savers, it has to come from somewhere.

Making ISAs less generous to the very richest seems like a sensible place to start.

Manage all your savings accounts in one place with Raisin, the simple savings service

*This article contains affiliate links, which means we may receive a commission on any sales of products or services we write about. This article was written completely independently.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature