How to make sure you have enough money in retirement

Millions of workers are being enrolled into workplace pension schemes, but will these schemes pay a big enough pension?

Most people probably know about the Government’s new workplace pensions by now, but perhaps fewer people understand that the contribution levels for the scheme are actually quite small.

So if you’ve already been automatically enrolled into a workplace pension, don’t assume you’re all set for a comfortable retirement.

Right now, the minimum contributions for a workplace pension are 1% of salary from the employee and 1% of salary from the employer. By October 2018, the employee’s minimum contribution will be 5% while the employer’s will be 3%.

You might think that paying in 8% of your salary would generate a decent pension, but these projections from Hargreaves Lansdown suggest that’s not true:

Pension contributions starting at 22*

|

Annual salary |

Contributions per month at 8% |

Total combined and state pension (annual) |

Replacement rate |

|

£15,000 |

£62.21 |

£11,161 |

74% |

|

£30,000 |

£162.21 |

£17,047 |

57% |

|

£50,000 |

£238.55 |

£21,539 |

43% |

|

£100,000 |

£238.55 |

£21,539 |

22% |

Source: Hargreaves Lansdown

So if you started work at 22 on a £15,000 salary, and worked until you were 68 on the same pay, you’d have a total pension income of £11,161 when you retired. That works out at 74% of your annual salary – hence the 74% ‘replacement rate’.

Remember this pension income includes the State Pension as well as your workplace pension.

The replacement rate falls for higher incomes because, of course, the Basic State Pension is no bigger for high earners. What’s more, auto-enrolment only applies to incomes between £5,668 and £41,450 a year. So if you earn more than that, your employer is under no obligation to make pension payments for any income beyond £41,450.

Now let’s look at a table for people who don’t start making pension contributions until they’re 35:

Pension contributions starting at 35*

|

Annual salary |

Contributions per month at 8% |

Total combined and state pension (annual) |

Replacement rate |

|

£15,000 |

£62.21 |

£9,058 |

60% |

|

£30,000 |

£162.21 |

£11,561 |

39% |

|

£50,000 |

£238.55 |

£13,472 |

27% |

|

£100,000 |

£238.55 |

£13,472 |

13% |

Source: Hargreaves Lansdown

I think this second table is quite scary. Someone earning £30,000 a year only gets a 39% replacement rate which I think is low. What’s more, we’re assuming you’ll get a State Pension of £7,500 a year. Given the state of the Government’s finances, there’s a decent chance that the State Pension will actually be cut back at some point.

So someone earning £30,000 a year could contribute to a workplace pension for 33 years and easily end up with a total pension income lower than £11,561.

What replacement rate do you need?

I think the really crucial question here is what replacement rate will you need?

For some folk, 39% or less may be enough. But others will struggle. Here are some of the main factors that will affect what replacement rate you’ll need:

- Housing costs. If you own your home and you’ve paid off your mortgage, you’re in a great position.

- Your family. Are there people who still rely on you financially?

- Your lifestyle. Do you plan to travel the world or are you going to stay at home and watch Countdown?

- Your health

- The size of your salary when you worked. People on a low salary may need a higher replacement rate so they can meet basic living costs.

What to do

I suspect there’s now a decent chance you’ll be worried that your workplace pension won’t be enough. If that’s the case, there are really only two solutions.

Firstly, you could try to persuade your employer to contribute more than the statutory minimum. In fairness, many employers do that. Secondly, you can save more money yourself.

Your extra saving doesn’t have to be into your pension scheme. Instead you could make regular contributions into a Stocks and Shares ISA and build up a secondary retirement pot that way.

And if you think you’ll struggle to find enough cash to save for your retirement, the answer to that problem may well be better budgeting.

We’ve written lots of articles on Lovemoney about budgeting, but the essential tenets are:

- Figure out where your money is going right now

- Spot areas where you can cut back

- Draw up a new budget and stick to it

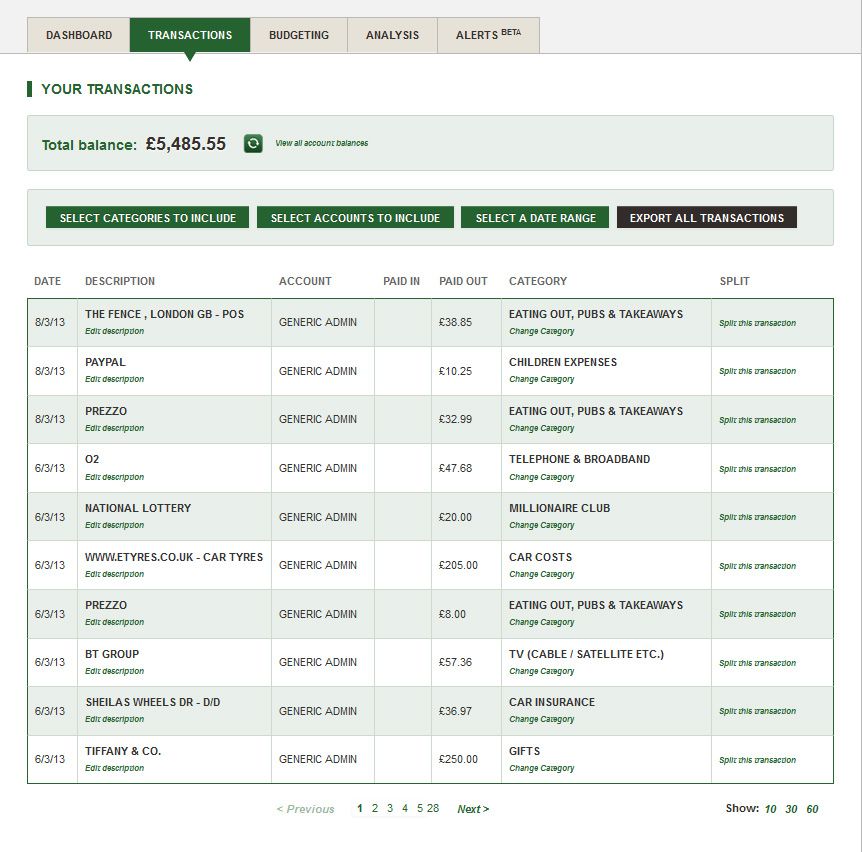

At Lovemoney we have a tool that can make budgeting so much easier – MoneyTrack.

With MoneyTrack, you can see all your card spending on one page – from all your credit cards and bank accounts. Even better, our tool automatically categorises your spending so that you can see if you’re spending too much on eating out, transport or something else.

Categorisation with MoneyTrack

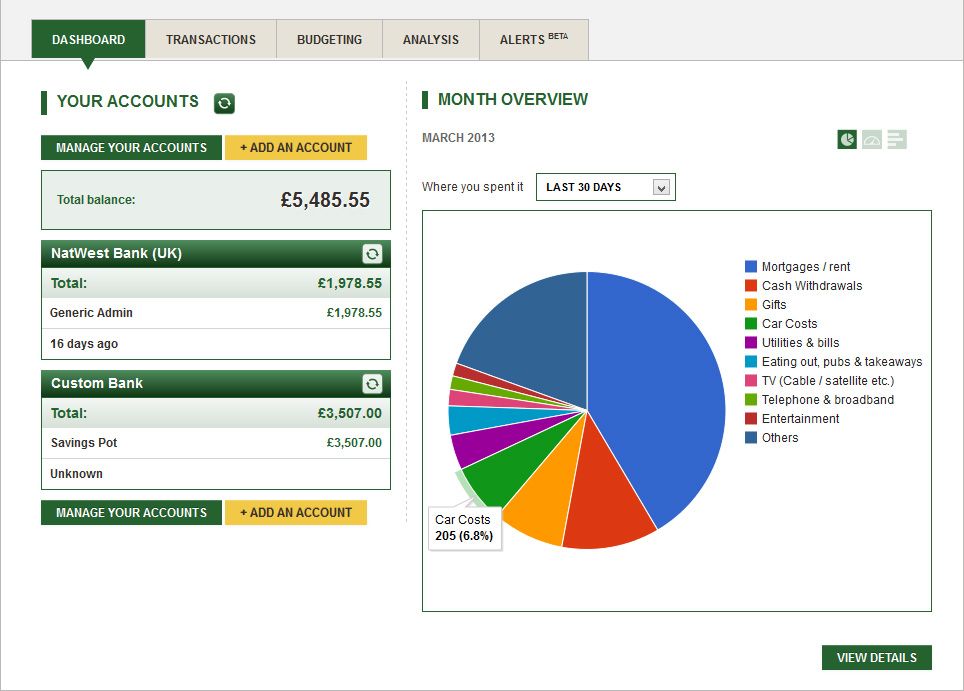

Then you’ll get a pie chart showing how your spending is split.

Moneytrack pie chart

You can read more about how MoneyTrack works in How to budget successfully.

But it doesn’t end there. If you want to plan really effectively for retirement, just analysing your spending isn’t enough. You also need to know how rich or poor you are right now – you need to know your financial balance sheet.

Lovemoney is about to launch a second tool that should make it much easier for you to figure out your current financial position. This tool will be called Plans and you can register your interest in the product right now on our Plans landing page.

Good idea

Don’t get me wrong though. I think auto-enrolment/workplace pensions are a great idea. The vast majority of people should stay in the scheme and not exercise their right to opt out. You just need to know that auto-enrolment on its own may not be enough to give you a decent retirement.

*Assumptions:

Retirement age: 68

Contribution of 8% of earnings between £5,668 and £41,450

Investment growth: 6% a year (including inflation)

Charges: 0.75%

Annuity rate: 5.5%

State Pension: £7,500 a year

More from Lovemoney

Workplace pensions: what it means for you

Workplace pensions: how NEST will invest your compulsory pension

The four-step guide to a comfortable retirement

Why retirement is bad for your health

Workplace pensions: NEST restrictions will be lifted

You must put 20% of your salary towards your pension!

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature