Five million struggle with payday countdown each month

15% of workers say that they run out of money before payday every single month. 41% say that this happens at least once a year.

New research from the Post Office shows that many are struggling to make their pay cheque last through the whole month. And that’s having an effect on the country’s health. One in four people say that financial problems have made them feel sick, while another quarter say that they have had sleepless nights fretting about how they are going to cover their costs.

What’s more, 17% adopt a ‘head in the sand’ solution to this problem and stop checking their current account as the end of the month approaches.

Understandable

It’s understandable that many people are sticking their head in the sand. But it’s not the sensible approach. If you’re regularly running out of money before the end of the month, you should be checking your current account more frequently not less.

And you shouldn’t just monitor your current account, it’s also good to keep an eye on all your spending – whether that’s on your credit card, your debit card or in cash. Lovemoney’s MoneyTrack tool can make this process much easier.

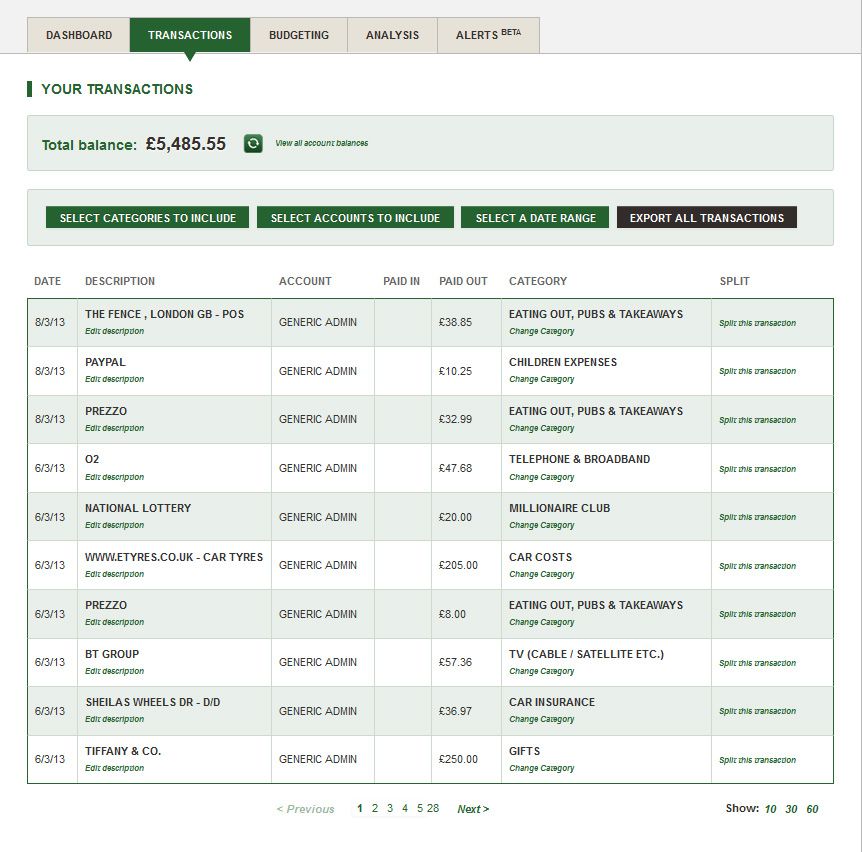

You can see all your spending on one page – even if you have credit cards and current accounts from more than one bank.

What’s more, your spending is automatically placed into different categories such as ‘eating out, pubs & takeaways’ or ‘telephone & broadband’. You can make changes to the categorisation if you wish or even create your own personal categories.

And if you buy a lot of goods in one shop, you can split up the transaction and categorise different components separately. For example, a Blu-ray movie bought as part of a ‘weekly shop’ at Tesco can be identified separately.

Useful

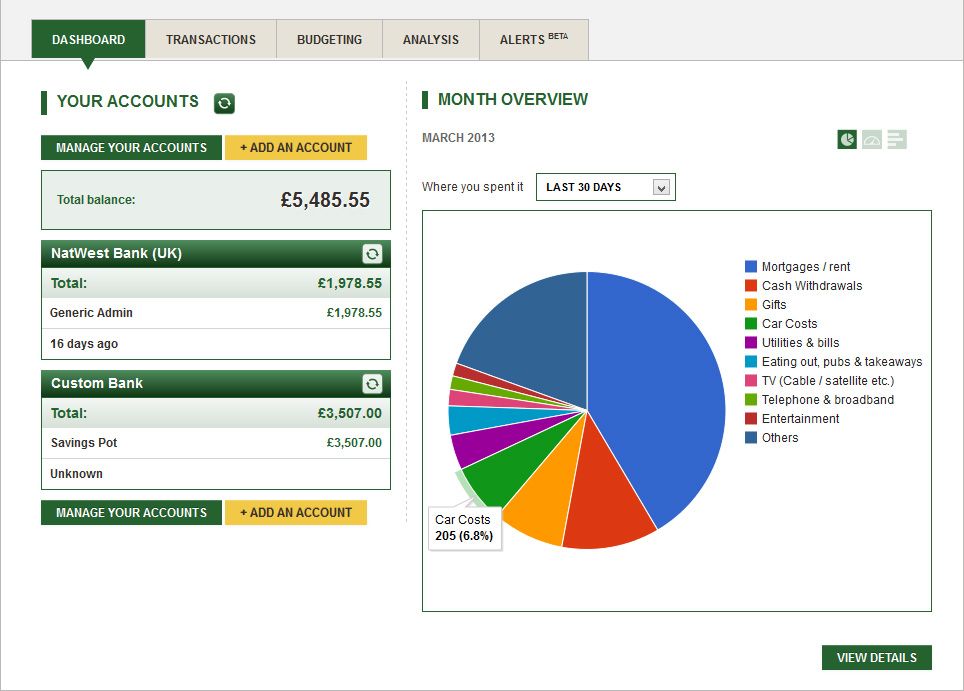

Splitting your spending into different categories is a useful exercise because it should help you spot areas where you could cut back on your spending.

Our MoneyTrack dashboard makes it easy for you to see which categories are consuming the most money:

Hopefully you’ll now be able to create a new budget for yourself with tough, but realistic, targets. So if you spent £100 on ‘eating out, pubs & takeaways’ last month, perhaps you could cut that back to £75.

You can then load these budget targets into MoneyTrack and then regularly to see if you’re on track to meet your monthly budget targets or not.

We’re not suggesting that MoneyTrack is going to cure all your financial problems. But the earlier you know you’re overspending, the quicker you can take corrective action and cut back on your spending.

Where to cut

Granted, it can be hard to take that corrective action. It may seem like there is nothing you can cut. But if that’s the case, take a look at our ‘Big budget month’ series of articles that have all sorts of suggestions on ways to cut your spending.

For example, you could focus on finding freebies as much as possible using sites such Freegle, Freecycle and freebielist. Or you could make sure that you always use cashback websites such as Quidco when you shop online.

You might also find that you can spend less on food. The trick with food is to plan ahead. Draw up a food planner before you make any purchases and make sure that you shop for meals not food. You can read more tips in Big budget month day six: save money on food.

Wherever you find scope for cuts, MoneyTrack can help you follow through and stick to your plans. And if you’re someone who has always spent your pay cheque before the end of the month, that can change!

More from Lovemoney:

Your ‘to do’ list is costing you money

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature