Energy, mortgages, market certainty: reasons to be (somewhat) upbeat about 2025

There are a few reasons to be cautiously optimistic about the prospects for our money in the year ahead.

It goes without saying that 2024 hasn’t been an easy year for our money.

However, there are some positives on the horizon.

Here are some financial reasons to be upbeat about the prospects for 2025.

To be clear, we're not saying it's going to be a great year financially – there are too many tax hikes on the horizon to make that statement – but simply that it's not going to be all doom and gloom.

Mortgage rates still expected to fall - just gradually

The financial markets have widely been expecting further Base Rate cuts, following the two made by the Bank of England this year, with subsequent cuts to mortgage rates.

Analysts at investment house Vanguard expect the Bank of England to trim rates from 4.25% to 3.75% by the end of 2025.

Unexpectedly, despite the interest rate cuts this year, mortgage rates have actually increased recently, with many sub-4% rates disappearing from the market.

Industry commentators say this is due in part to an increased number of mortgage applications raising administrative costs for lenders and a rise in inter-bank lending rates.

The Bank of England recently held interest rates at 4.75% in December due to a surprise rise in inflation.

However, it is still widely expected to cut interest rates - it's just the cuts may be more measured than previously expected.

Andrew Bailey, the Bank’s governor, said after the recent Monetary Policy Committee (MPC) meeting, that he thinks “a gradual approach to future interest rate cuts remains right" but that with the "heightened uncertainty in the economy, we can’t commit to when or by how much we will cut rates in the coming year."

Financial markets are still pricing in the 45% probability of a quarter-point rate cut at the next MPC meeting in January.

Inflation to remain steady in 2025

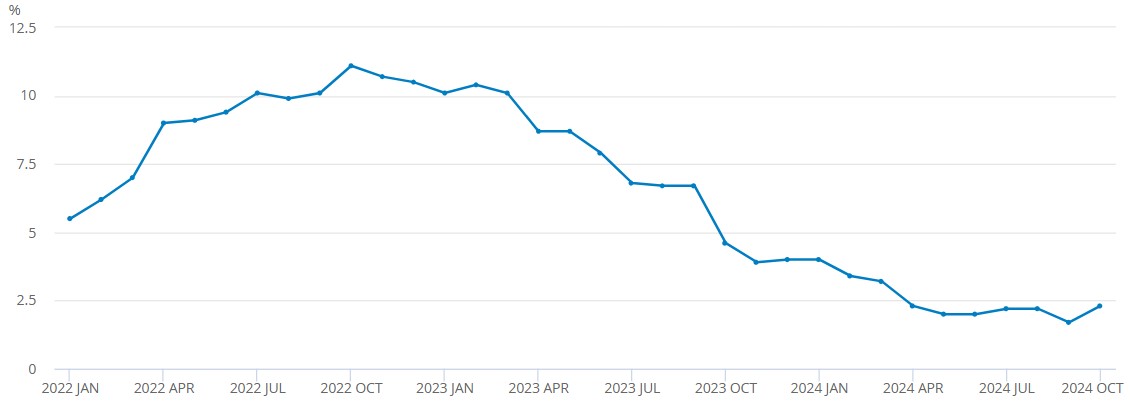

After almost two years of steadily falling inflation, the last two months have provided a shock to the system of sorts.

CPI first jumped from 1.7% to 2.3% in October, then to 2.6% in November.

There are also concerns that inflation could be stoked again due to concerns about incoming President Donald Trump’s plans to introduce trade tariffs.

Trump wants to put 60% tariffs on goods from China and 20% on those from other countries, including the UK, to encourage US people to buy American goods.

These could increase the price of many goods and lead to a global trade war.

Inevitably, these price hikes will be passed on to the customer.

The 'good' news is that inflation is likely to remain somewhere near its current level over the course of 2025: the Office for Budget Responsibility said it expected an average rate of 2.6% over the next 12 months.

While that's above the Government's 2% target – and certainly a cause for concern given the parlous state of our finances in a cost-of-living crisis – it's a comfort of sorts that inflation will remain broadly the same as in 2024, which has averaged 2.4% to date.

Graph: CPI inflation between 2022 and 2024 (source

Energy prices should fall next year

The price of energy has been a concern for many over the past three years, with the energy crisis fuelled by the Russian invasion of Ukraine meaning many customers were unable to switch tariffs.

Once again, we now at least have more choice over which supplier and tariffs we can sign up to.

Plus, while energy bills are expected to rise again in the New Year, they are forecast to fall over the course of 2024, which will be good news for many of us.

The Energy Price Cap, which covers England, Wales and Scotland, is set to increase in January.

From 1 January to 31 March 2025, gas prices will be capped at 6.34p per kilowatt hour (kWh), and electricity at 24.86 per kWh.

That means the typical annual bill for a dual-fuel household paying by direct debit will rise by around £21 to £1,738 a year from the previous Energy Cap.

However, the good news is that energy consultancy firm Cornwall Insight expects prices to fall slightly in April and again in October 2025.

This – if it transpires – should give us all our wallets some much-needed relief.

Shop around for a cheaper energy deal with Uswitch and save up to £100 (opens in new page)

Savers will still be able to beat inflation

As we said above, the OBR forecasts that inflation will average 2.6% across 2025.

With the Base Rate expected to sit somewhere between 4.25% and 3.75%, there’s a good chance savers can still shield their savings from inflation by moving to a decent account.

According to data service Moneyfacts, there are currently 1,629 savings accounts on the market that could help savers beat inflation, although this is slightly fewer than there were before the Bank of England’s decision to cut the Base Rate to 4.75% from 5%.

More market certainty following elections

It might not feel like it yet, but the fact that two major global elections are now out of the way provides a certain degree of certainty about the near future – whether you are pleased with the outcomes or not.

Stock markets hate uncertainty, which can make them volatile. Volatility is good for derivatives traders but bad for investors.

While some people may be unhappy about certain aspects of the Labour Government’s recent Budget, and the prospect of a second Trump presidency in the US, what it does give the markets is a nominal amount of certainty, which should be good news for investors.

Trump often trumpeted the strong performance of the US stock markets during his first term.

Indeed, the S&P 500 grew by 67% from his inauguration to his last day in office in 2021, despite the lows of the Covid-19 pandemic, although economic activity in the US remained below pre-pandemic levels.

However, it actually performed better under Barack Obama – rising 85%.

Meanwhile, the FTSE 100 grew by 47% from 4,455.6 to 6,549.6 under Tony Blair’s 10 years as prime minister, so we could expect decent growth under Labour.

However, this did encompass the Dotcom boom and bust, while his successor Gordon Brown soon found himself presiding over the subsequent financial crisis of 2008.

But, certainly, the UK economy is now forecast to grow more than previously expected next year thanks to measures taken in the recent Autumn Budget.

|

PROMOTION

|

||

|

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature