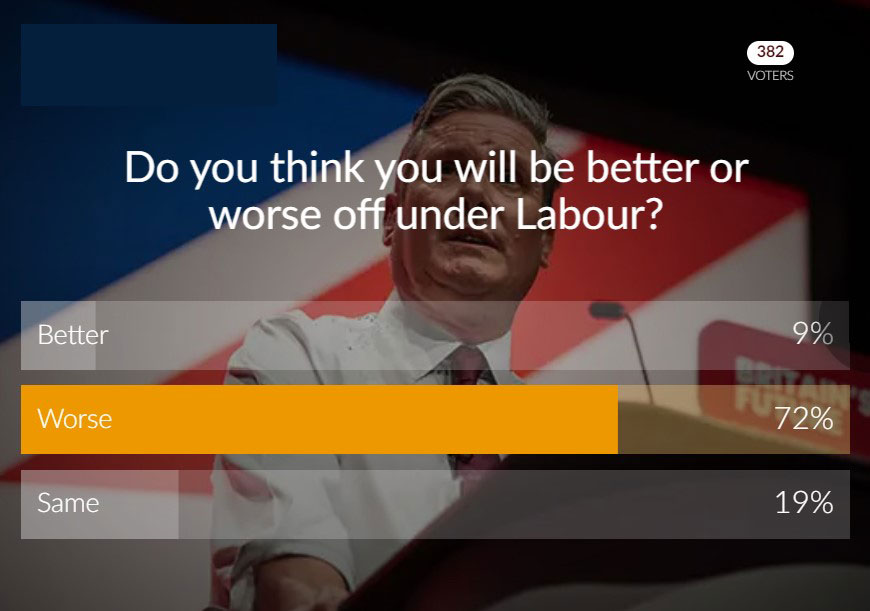

loveMONEY election poll: 7 in 10 expect to be worse off under Labour

Many readers expect financial hardships to intensify in the coming years.

Most loveMONEY readers believe they will be worse off financially under a Labour Government, a poll has suggested.

Labour brought an end to 14 years of Conservative rule after it won a resounding victory in the General Election last week.

Asked whether they thought they’d be better or worse off under a Labour Government, a remarkable 72% of readers chose the latter.

Fewer than one in 10 (9%) felt they would be better off, while just under one in five (19%) felt their financial outlook would be unchanged.

What Labour’s election win means for your money

A backdrop of financial struggles

Obviously, a poll of 380 people is hardly definitive, but it does reinforce a broader view that the cost of living crisis is far from over and that there are more tough times ahead.

While politicians will point to the fact that inflation is back at its official target of 2% as a sign that normality has returned, that does rather ignore the fact that bills remain substantially higher than they were two or three years ago.

As a case in point, recent research from Zoopla highlighted how mortgage repayments are a staggering 60% higher now than they were in 2021.

Similarly, average energy bills remain around 50% higher than before the cost of living crisis struck, while Office for National Statistics data shows food prices jumped 25% between January 2022 and January 2024.

Given these startling rises, it’s hardly surprising so many of us are facing financial hardship.

A recent survey by the Financial Conduct Authority estimated that 7.4 million UK adults are struggling to pay bills each month.

Difficult times ahead – no matter who leads?

Given such challenging conditions, it’s perhaps unsurprising that so many readers are pessimistic about their fortunes.

Indeed, there has been a lot of research in recent months suggesting that the financial forecast would be bleak regardless of the election result.

For example, the Resolution Foundation think tank said last month that UK households should brace themselves for tax hikes worth £800 regardless of whether the Conservatives or Labour were in power.

What to do if you're struggling

The cost of living crisis has been devastating for our finances – and these hardships are likely to continue for some time.

If you're among the millions of people struggling to pay the bills each month, it's important you take proactive steps to improve your situation.

This could come in the form of further cutting your costs, getting Government assistance or getting help to clear existing debt.

To help out, we've put together loads of useful guides, which you can take a look at here:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature