Ofcom to ban mid-contract price hikes linked to inflation in boost to customers

Broadband, mobile and pay TV firms will have to explain exactly what hikes they have planned.

The telecoms regulator Ofcom has ordered firms to be more upfront about the mid-contract price hikes they are planning.

In recent years, mobile, broadband and pay TV customers have advertised a lower contract price up front, but then hit customers every March or April with a hike linked to inflation plus an additional percentage.

These increases can be really significant – last year saw many of the biggest telecoms firms rolling out hikes of up to 17%.

This practice has long been one of the main customer gripes as it makes understanding the true cost of a contract impossible.

The good news is Ofcom has stepped to stop the practice, although the ban will only apply to contracts sign after 17 January, 2025.

From that date, telecoms firms will need to make it clear at the point of signing the contract exactly what hikes it is planning for future years in pounds and pence.

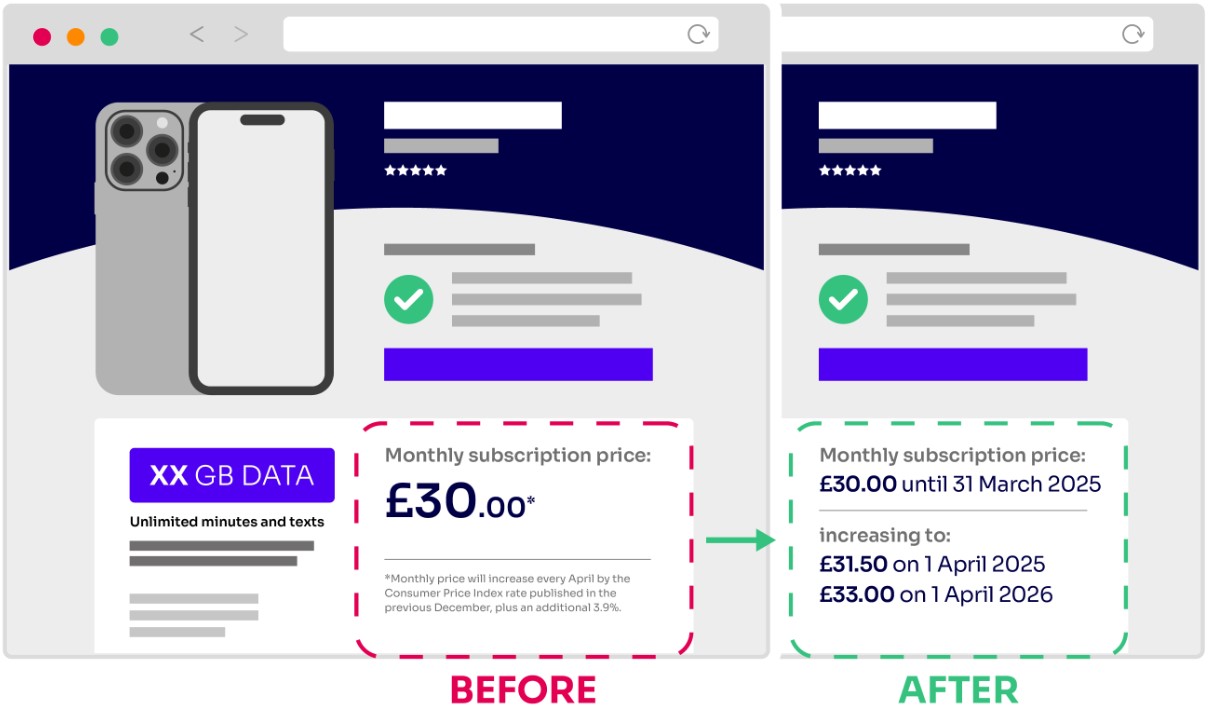

Ofcom has produced the image below to give providers an idea of what it expects to see on future contracts.

Mid-contract hike: here’s what will change

To be clear, firms will still be allowed to hike prices mid-contract – and to choose any level of increase they like.

All the new regulation will do is force firms to be clear about what they are planning to do, which will help you more accurately compare contract prices overall.

Ofcom has provided a great level of detail about exactly how the new process will work.

It’s worth looking at what it’s said so you can be sure providers are meeting these requirements when you sign up to telecoms contracts in the future.

How the process should work, according to Ofcom

- Wherever telecoms or pay TV providers include price rises in their contracts, they must set these out clearly in pounds and pence, before a customer signs up.

- Providers must draw this information to the customer’s attention prominently before they are bound by the contract, in a clear and comprehensible manner (including during a sales call or other verbal sale such as an in-store sale) to enable them to make an informed choice.

- Providers must also set out when any changes to the monthly price will occur.

- Providers may increase their prices during the contract period and the new rules do not restrict their ability to set the level of their prices.

- However, they will prohibit providers from including inflation-linked, or percentage-based, price rise terms that apply to the Core Subscription Price in new contracts. This will give consumers clarity and certainty about the price they will pay, helping them choose the best deal for their needs.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature