Premium Bonds: will the prize fund rate be cut?

NS&I has overshot its financing targets, so could Premium Bond holders lose out as a result?

Premium Bonds could see the annual prize fund rate being cut after it was revealed that NS&I ended up raising too much money last year.

The Government-backed savings organisation attracted £11.3 billion in its last financial year – overshooting its £7.5 billion to £10.5 billion financing target.

And analysts believe this may result in “more heavy-handed” cuts over the coming months, especially as the Bank of England has started lowering the Base Rate.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: “Given that Premium Bonds make up well over half of all the money held in NS&I, they’re highly unlikely to be spared.”

Manage all your savings accounts in one place with Raisin, the simple savings service

Why has this happened?

Earlier in its financial year, NS&I had been trying to boost savings rates, which resulted in the Premium Bond prize rate hitting a 24-year high of 4.65%.

It then launched some highly competitive one-year bonds that attracted £10 billion – but people didn’t end up withdrawing cash as expected, according to Coles.

“In January, it announced a cut in the Premium Bond prize rate, effective from March, but it said this didn’t have as much impact as it expected,” she said.

This means that Coles expects NS&I could decide to make more substantial cuts over the coming months, which will leave savers with a conundrum.

What should you do?

However, Coles believes some people will choose to hang onto the bonds regardless because the outside chance of a big win is worth the likelihood of winning nothing.

“For others, however, it could be enough to persuade them to look for savings accounts and cash ISAs elsewhere, especially while rates remain so robust,” she said.

Myron Jobson, senior personal finance analyst at Interactive Investor, believes the Base Rate cut means the best savings rates are on borrowed time.

“Those who can afford to put money away for at least five years or more should consider investing for the potential of long-term, inflation-beating returns that far outstrip savings rates,” he said.

Manage all your savings accounts in one place with Raisin, the simple savings service

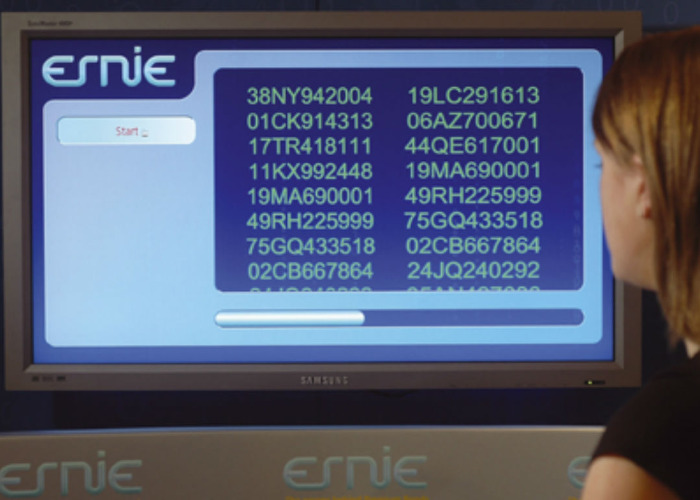

What are Premium Bonds?

The lottery-style premium bonds give savers the chance of winning one of two £1 million jackpots, as well as many smaller amounts.

The prizes are tax-free and the odds of winning are 21,000 to 1 for every £1 Bond in the monthly prize draw. The minimum you can pay in is £25.

However, Premium Bonds don’t earn interest. The nearest it gets to this is the annual prize fund rate which can vary. At the moment, this rate is 4.4%.

During 2023 there were 64 million premium bond prizes given out with a total value of more than £4.6 billion. Twenty-four people became jackpot millionaires.

The latest jackpot millionaires – announced in August 2024 – hailed from outer London and Devon. They were part of the 5.9 million prizes worth more than £457 million drawn this month.

Our guide to Premium Bond myths highlights the misconceptions people have about these popular products.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature