Virgin Money to roll out current account across UK from April

Basic bank account that pays 1% interest to be made available nationwide.

Challenger bank Virgin Money has confirmed it will roll out its debut current account in England and Wales from April.

The Virgin Money Essentials Current Account launched in August last year, but was only available in Scotland and Northern Ireland.

What the Virgin Money account offers

The Virgin Money Essential Current Account is what’s known as a basic bank account.

These types of accounts are designed for people on low incomes or who have a poor/non-existent credit history and so can’t access standard deals.

Typically they’re no-frills and allow simple functions like paying in money, paying bills and withdrawing cash.

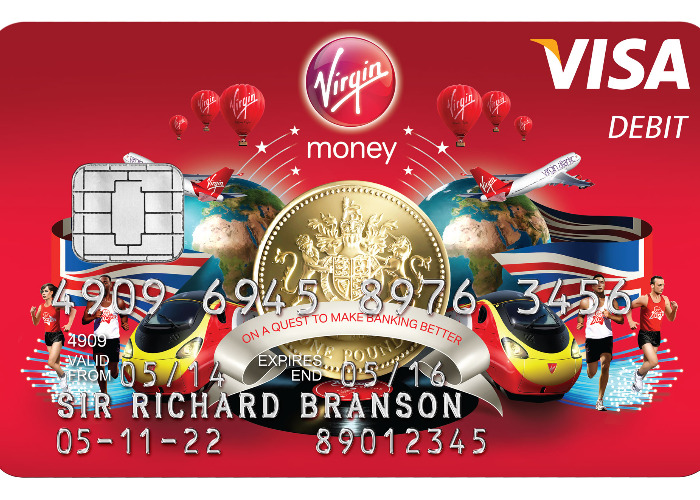

The Virgin Money Essential Current Account ticks all these boxes. It doesn’t come with an overdraft or chequebook, but does allow you to set up Direct Debits and Standing Orders and comes with a Visa debit card to use at ATMs, as well as for purchases in the UK and abroad.

However, unlike other basic current accounts it also pays 1% variable interest on balances up to £100,000.

The account also doesn’t charge you for bounced payments and only comes with a few straightforward charges like overseas transaction fees (purchase fee of 2.99% and cash fee 2.99% + £1.50), a CHAPs fee (£35) and an additional paper copy statement fee (£10).

Becoming a Virgin Money customer will also bring perks like discounts on Virgin Trains, Virgin Experience Days and free access to Virgin Lounge rooms across the country.

The Essential account can be opened solely or jointly and you can manage your money using the Post Office and Virgin Money stores as well as online, mobile and telephone banking.

Compare basic current accounts

Free banking model ‘stifling competition'

The nationwide launch of the Virgin Money current account will bring some fresh competition into the market, especially for those in need of a basic bank account.

However, Jayne-Anne Gadhia, chief executive of Virgin Money, says a change to Britain’s free in-credit banking model is needed in order to really shake things up

Ms Gadhia told the Financial Times: “The reason we don’t have enough account switching in my view is not that customers have such a great deal with their existing bank, nor that there’s an obstacle to switching, but that there’s no differentiation between current accounts.

“Due to the similarity of products from the incumbent banks, they’ve got the market locked. It’s bad for pricing and innovation. If we want the UK banking system to thrive in future, it needs to be addressed.”

Ms Gadhia explained more transparency in charges is needed.

“For the vast majority, the current account is not free because a number of people suffer penalty charges. Everyone suffers because credit balances are used by banks to fund assets and customers don’t get adequately rewarded for that,” she added.

“Over time, banks have to bundle up products to make current accounts work financially for them and that is where one product has subsidised another — then we have a mis-selling problem, like we have with payment protection insurance.”

The Competition and Markets Authority is currently investigating the current account market over concerns Britain's 'big four' banks - Lloyds, Royal Bank of Scotland, Barclays and HSBC - dominate the market, while things like complex overdraft charges are making it difficult for people to shop around.

Ms Gadhia’s comments coincide with a report released by consultancy firm PwC this week, which said the free banking model in the UK was unsustainable and would increase the likelihood of mis-selling.

It found that while 66% of people surveyed were aware of hidden current account fees, one in two would be likely to change banks if an upfront fee was imposed.

Steve Davies, retail banking leader at PwC, said a better approach was to charge for “reasonable services”, which would reduce the risk of banks trying to sell other products to recover costs.

More on banking:

Post Office Money brand unveiled

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature