New scam targets people who have recently registered a business

People are being contacted shortly after registering with Companies House to pay a 'fee'.

The National Fraud Intelligence Bureau (NFIB) has warned of a new scam asking newly-listed businesses to pay a 'fee' to confirm registration.

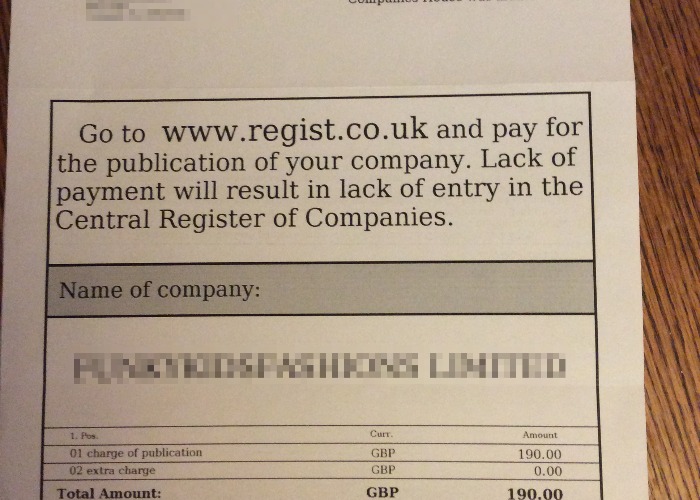

Victims will receive a letter from Register of Companies and Businesses, which claims to be linked to Companies House. The recipient then needs to “confirm their registration” by paying a fee.

A £190 payment is required by a set date to register and publicise new company information. The firm's website says that the fee is for entry into the register which operates in the UK, giving you access to the website’s services.

The letter goes on to say that “lack of payment will result in lack of your company’s entry in regist.co.uk”, suggesting that it is a required part of company registration.

Similar scams

Companies House has recently published a rundown of similar business scams.

- Firstly, ignore similar money requests from National Register of Companies, Economic Index for Europe and New Companies Register, as they are all bogus.

- Companies have been contacted by people claiming to be from Companies House, asking them for details of their company’s directors. If this happens, try getting hold of a return telephone number and phone Companies House immediately on 0303 1234 500.

- There have also been reports of fake job adverts featuring highly-paid roles in the oil, hotel and banking industries. These posts may ask for money upfront so be vigilant.

- As you can imagine, there have been a fair share of scams following pension reforms. In some cases, individuals have had limited companies established under their name. If you believe you’ve had a company set up in your name, be sure to seek legal advice before taking any action to close it.

- Other schemes include emails claiming to be a response to an online filing submission. These emails should be forwarded to phishing@companieshouse.gov.uk and then deleted.

- On a similar vein, people are being swindled into giving a fiver by credit or debit for a so-called late filing submission to stop further action being taken. Companies House will never cold call you for payments.

Keep yourself safe

Avoiding these scams is fairly straightforward if you're careful. As long as you don't respond to suspicious communications, especially ones that ask for a fee, you should be fine. And it goes without saying that you should never give away your bank details unless you can verify that the recipient is legitimate.

Contact Action Fraud on 0300 123 20 40 or use its online reporting tool to flag any scams.

Compare personal loans with loveMONEY

More on scams:

Millions lost to phone scam cash transfer trick

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature