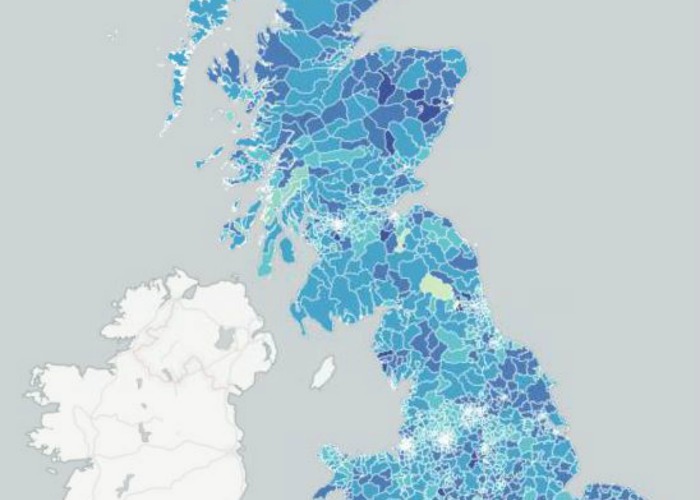

ClearScore map reveals credit scores by postcode

A new map shows how we're doing on our credit scores based on our postcodes.

Credit rating firm ClearScore has released an interactive map, revealing who handles their money best based on their postcode. Almost 10 million British people have had their score analysed and matched to postcode districts across the country.

Justin Basini, ClearScore founder and CEO, said that though the area you live doesn’t determine your personal credit score, lenders may use ‘postcode profiling’ as an overall indication of the risk associated with a particular area.

"If you have an excellent personal credit score then you should have no problem successfully applying for credit, even if the average for your postcode is low. But those with a low score who also live in an area with a lower average could face greater scrutiny and be held back,” he explained.

Residents of Kirkwall in the Orkney Islands scored the highest at 454, 19% higher than the UK average of 380. South East London only scored 361, putting it at the bottom of the table.

See how your postcode fares on the interactive map below.

How can you improve your credit score?

There are lots of ways to improve your credit score:

- Get yourself on the electoral roll. This is one of the first things a lender checks, to ensure you are who you say you are. If you’re not registered or registered at an old address you may be refused credit;

- Make at least the minimum payment on any credit you do have, on time, every month;

- Be careful about making multiple card applications. Numerous knock-backs will pummel your score;

- Ask for a ‘soft search’ or ‘quotation search’ if you just want to find a quote for a loan or mortgage, for example;

- If you're financially linked with someone, you'll share a credit history (on top of all of the other history). If you don't want to be linked with them any longer, sever those ties, especially if they have a dodgy credit rating.

Find out more at How to improve your credit rating.

Check your credit report right now

Sort your credit score out:

What damages your credit rating

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature