The insurers who will give you extra contents insurance cover this Christmas

Find out who will give you that little bit of extra cover this Christmas.

Christmas is a time for excess, be it food, booze, parties or all three.

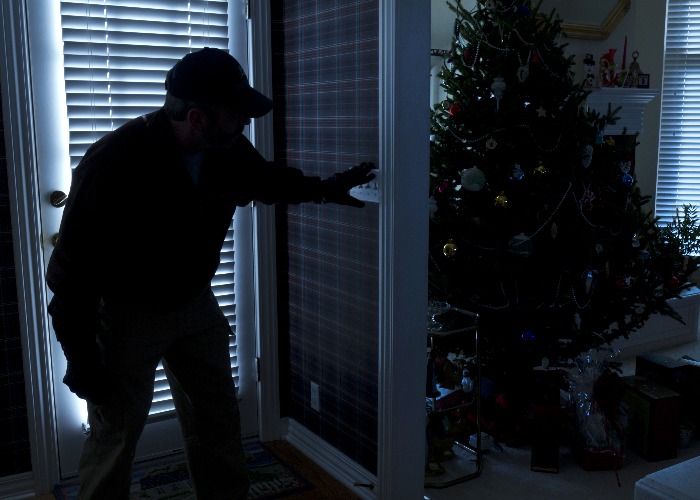

Sadly, it can also be a time of accidents and break-ins. Thankfully some insurers give you a bit of extra cover at this time of year to help you cope with breaking appliances, theft and festive fumbles like toddlers and that fourth glass of wine.

Contents insurance over Christmas

With so many additional valuables in the house over Christmas, including gifts, food and alcohol, some insurers will bump up your home insurance claim cover to account for Christmas mishaps, and in the majority of cases it'll be added automatically.

AA

AA is giving customers a generous 20% increase on contents cover between 1 December and 6 January to include items bought for Christmas.

Age UK

Age UK increases its contents cover by 10% for religious festivals.

Direct Line

Direct Line automatically ups its contents insurance by 10% for 30 days either side of Christmas.

Halifax

Halifax automatically increases the limit of its contents cover by up to 10% during the month of December.

Lloyds

Lloyds also automatically increases your insurance by up to 10% during December.

LV=

LV= raises its cover by 10% automatically one month before and after the big day.

NatWest

NatWest gives customers 10% extra on contents but this excludes its Essentials cover.

Policy Expert

Policy Expert increases its contents cover by 10% over the course of December.

Post Office

Post Office is giving its contents customers an extra 10% over Christmas, raising its cover from 25 November to 25 January.

Saga

Saga is offering £2,000 of additional cover for personal belongings during December.

Swinton

Swinton offers up to 10% more on contents insurance at Christmas and other religious festivals.

Tesco

Tesco Bank is with the majority, giving customers a 10% higher contents cover limit over Christmas.

Make sure you're fully covered

A surprising number of homeowners and renters don't have accidental damage cover on their home insurance. Despite its unpopularity, accidental damage cover can be ideal if you have unpredictable house guests (we're thinking toddlers) or there's likely to be breakages and spillages over the holidays. Everyone knows that red wine is a nightmare to get out of a cream carpet! Speak to your insurer if you don't know what's included in your home cover.

It's important to re-evaluate your insurance policy after Christmas to account for your new haul, particularly if you get valuable items like jewellery or electronics. Your insurer may not pay out in full if you're under-insured.

Find out how to Cut your home insurance costs.

What you should read now:

Which new social class are you?

What are your biggest money regrets?

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature