Premium Bonds prize rate to rise from December 2017

Boost for Premium Bond holders and all other NS&I savers as rates to rise by 0.25% starting December 2017.

The number of large prizes that Premium Bond holders can win will rise for the first time in seven months starting from the next draw.

Following the 0.25% Base Rate hike earlier this month, some banks and building societies have begun passing on the increase to long-suffering savers.

And now it's the Government-backed National Savings & Investments' (NS&I) turn, hiking the Premium Bond prize rate from 1.15% to 1.4% as of the December draw.

The increase means the odds of winning any prize will improve from 30,000 to one to 24,500 to one.

What's more, there will also be an increase in the number of big-value prizes.

There will be an extra £100,000 prize up for grabs, while the number of £50,000 and £25,000 giveaways rise to nine and 18 respectively.

See below for the full list of changes.

|

Value of prizes

|

Number of prizes in November 2017 |

Number of prizes in December 2017 (estimate) |

|

£1,000,000 |

2 |

2 |

|

£100,000 |

3 |

4 |

|

£50,000 |

5 |

9 |

|

£25,000 |

12 |

18 |

|

£10,000 |

28 |

42 |

|

£5,000 |

57 |

87 |

|

£1,000 |

1,366 |

1,660 |

|

£500 |

4,098 |

4,980 |

|

£100 |

22,190 |

22,792 |

|

£50 |

22,190 |

22,792 |

|

£25 |

2,325,993 |

2,853,919 |

|

Total: |

2,375,944 |

2,906,305 |

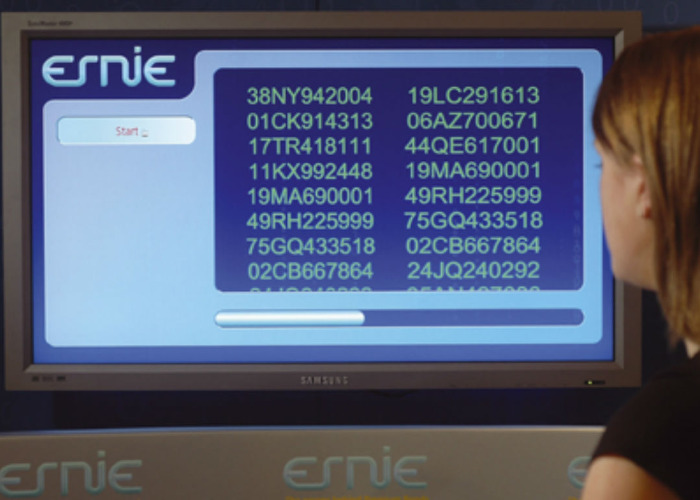

Were you a winner in the most recent Premium Bond draw?

What else is changing?

Of course, NS&I offers a lot more than just Premium Bonds. The saving institution has announced it will be hiking rates on all existing products as well, which you can see in the table below.

It deserves full credit for passing the full 0.25% increase on to customers (even if punters with average luck would be better off elsewhere). Some banks have only passed on part of the hike, while others haven't bothered at all.

So, well done NS&I on that front.

|

Product |

Current rate |

New rate (from 1 December 2017) |

| Premium Bonds | 1.15% | 1.40% |

|

Direct ISA |

0.75% tax-free/AER |

1.00% tax-free/AER |

|

Direct Saver |

0.70% gross/AER |

0.95% gross/AER |

|

Income Bonds |

0.75% gross/AER |

1.00% gross/AER |

|

Investment Account |

0.45% gross/AER |

0.70% gross/AER |

|

Junior ISA |

2.00% tax-free/AER |

2.25% tax-free/AER |

Get a better return on your money by lending it out through a peer-to-peer site (capital at risk)

Get a better return on your money by lending it out through peer-to-peer lending (capital at risk)

Got a question about Premium Bonds? Read these articles:

How to buy Premium Bond or claim lost prizes

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature