Premium Bond prizes: one in five win nothing – poll

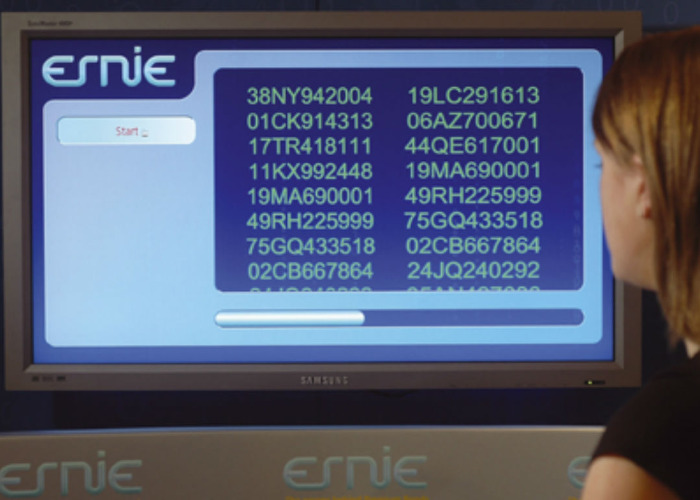

A poll of loveMONEY readers shows almost one in five Premium Bond holders have never won a prize. How are your bonds faring?

Almost a fifth of loveMONEY readers who invest in Premium Bonds have never won a prize of any sort, a new poll has found.

A further third have never won more than £25, meaning half of us have failed to collect anything more than the lowest value prize on offer.

It’s an interesting stat, given that around a third of our readers have invested between £10,000 and £50,000.

Obviously your returns are based purely on luck.

And while some will boast a frankly phenomenal success rate, our poll suggests many of us are achieving a paltry return.

Have a look at the winnings in our poll results below (based on 1,400 votes).

Penalty for those with larger holdings

If you only have a small amount invested in Premium Bonds, the penalty for not winning is insignificant.

I hold £100 in the bonds, and although I’ve not won anything I’ve missed out on around £40 worth of interest during that time had I simply put the money in a savings account.

But the penalty of having poor luck becomes far greater for the significant number of readers with hefty Premium Bond holdings.

A recent study by investment firm Axa found that investing in the FTSE 100 would have returned on average 70% over a 10-year period. So on a £10,000 investment, that works out to £7,000 over a decade.

If you had a similar sum invested in Premium Bonds and had enjoyed average luck you’d have earned less than £2,000.

A declining investment

Another consideration is the fact the prize rate on Premium Bonds keeps falling. In the last draw, the rate fell by 0.1% to 1.15%.

In contrast, traditional savings accounts are actually rising (albeit marginally).

Financial data site Moneyfacts found the average rate offered on one-year fixed-rate savings accounts has edged up 0.05% since January, while five-year accounts are up 0.14%.

You can view all the top-paying savings rates in our best buy tables.

What are your options?

We don’t want to be overly critical of the bonds. We know how hugely popular they are, giving punters the chance of becoming a millionaire each month without losing their initial stake.

But as we’ve often written, if your main interest is a risk-free lottery, you’ll probably be better putting your money in a top-paying savings or current account (which offer rates of up to 5%) and using the interest you earn to buy lottery tickets.

What’s more, your lottery ticket will ensure some money goes to charity.

In truth, this strategy works best for those with small savings (say under £5,000), as the top-paying accounts usually have strict limits on how much you can hold in them.

It still holds true for those who have tens of thousands to set aside, it’s just that the difference is less notable.

The bottom line is that, while Premium Bonds could make you a millionaire, you need to think about the cost over the long-term.

If you have a large sum to set aside, you can turn that into an almost-certain fortune by investing it for decades.

How lucky have you been?

A final word, we’d love to hear how you’ve fared from your Premium Bond holdings so far.

Please do vote in the poll below on the average rate of return you’ve achieved over the years.

Read more on loveMONEY:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature