TSB scam emails and texts – how to spot a fake message

Scammers have been sending emails and texts purporting to be from TSB in a bid to con victims of the recent IT meltdown out of money. Here’s how to tell a genuine message from a fake one.

TSB customers are being targeted by scam emails and texts purporting to be from the bank.

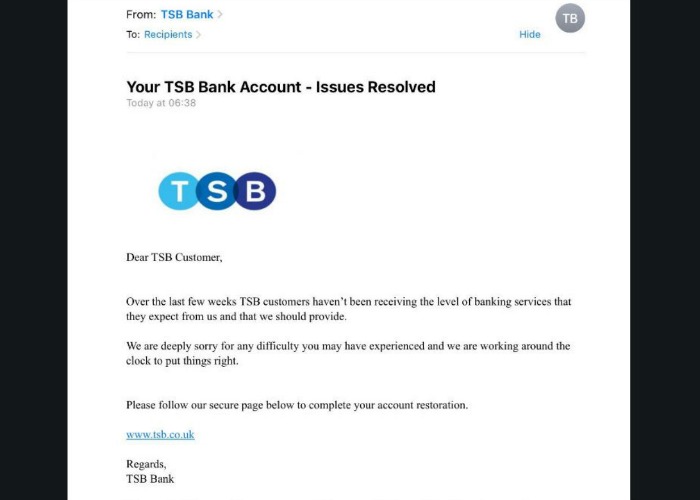

The ‘phishing’ scams come as TSB struggles to recover from weeks of IT chaos, with some emails and texts asking recipients to click links for ‘account restoration’ or setting up new online banking details.

Action Fraud warned on Friday that there had been a surge in fake ‘account restricted’ emails from 'TSB', claiming that customers’ accounts have been suspended for unusual activity and ask recipients to click links to unlock their accounts.

We've contacted TSB about what they're doing to keep customers informed about scams and staying safe, but they were yet to respond at the time of publishing.

Examples of scams

Many of the scam emails from TSB look relatively genuine, featuring the TSB logo, the bank’s address and referencing recent IT problems:

@TSB possible phishing scam...received today pic.twitter.com/rQ26DwOciV

— Claire Thomas (@ClaireBear_1981) May 13, 2018

The links often lead to ‘cloned’ bank webpages which look like actual bank webpages, warns Action Fraud.

@TSB is this another phishing scam? pic.twitter.com/g9hwWOnKzN

— David Burnand (@davidburnand) May 11, 2018

We tried clicking on the supsicious link texted to both TSB customers and non-customers over the weekend in a bid to show you what to look out for.

However, we found that the page had been suspended. Several other links from suspicious emails and texts had already been taken offline as well.

How to spot a genuine TSB email

Spotting a genuine TSB email is relatively easy; you just need to look out for certain key features.

Firstly, the email will quote the last four digits of your account number. Whilst it’s possible scammers might have this information, it’s unlikely.

Secondly, the links in the email or text will lead to the official TSB website tsb.co.uk. Never click on the links – you can find out the address by hovering your cursor over the links.

Here is a genuine TSB email with these two features:

You can also check the sender address: it should come from tsb@email.tsb.co.uk, donotreply@tsb.co.uk, tsb@tsbinsurance.co.uk or haveyoursay@email.tsb.co.uk.

If you’re on a mobile device you’ll need to actually tap on the sender name to find this out.

TSB has more information on its website about spotting scam emails.

What your bank will never ask you

Another way to stay safe is to keep in mind what information TSB would ask you for – and the same rules apply to most banks.

Unsurprisingly, genuine emails and texts will never ask for your PIN, card details or online banking passwords, or ask you to handover cash, cards or purchase land or commodities.

Nor should genuine emails or texts contain links to webpages that ask for your username or password, as this could be a ‘cloned’ page set up by the scammers.

@TSB Is this you sending me this link to click or a scam? pic.twitter.com/w9gProThK5

— Janice bristow (@Janicebristow) May 11, 2018

You should also be wary of emails that ask you to carry out a ‘test’ transaction online or authorise a payment.

If you get any such emails or text, report them to TSB and Action Fraud immediately.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature