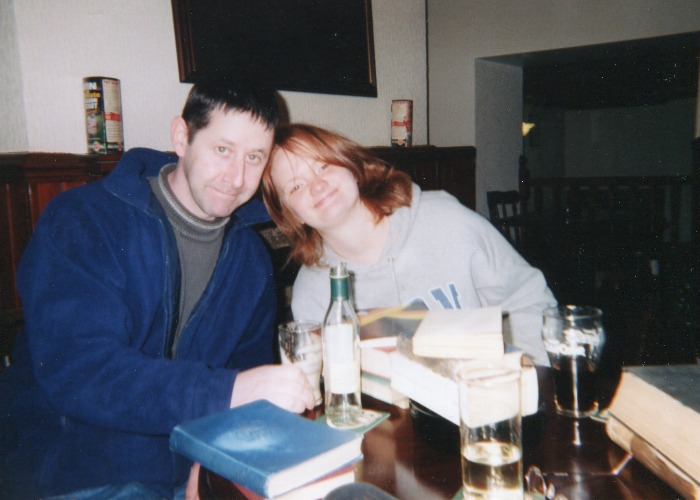

Debt and relationships: why I hid my £10,000 debt from my partner

Would you conceal money worries from your significant other? Our writer did.

I have a secret to share and it’s not something many people know about me.

But confession is meant to be good for the soul so here goes… I have debts of almost £10,000.

During the past few years, a combination of money mistakes and family illness has hit my finances hard and I owe money for the first time in my life.

You’re probably wondering why I’d make such an embarrassing admission online and open myself up to unflattering (and probably fair) ridicule from readers.

The truth is I’m not 100% sure myself.

In fact, I’ve been far less forthcoming with those in my personal life who (arguably) had a right to know.

My boyfriend of two years only learned of my financial position a couple of months ago when he suggested buying a house together.

I’m far from alone. According to research from insurer Direct Line, 16% of Brits in a relationship have debts their partner isn’t aware of, with average concealed borrowings of £8,293.

Across the UK, these hidden debts equal £69 billion.

While these statistics are shocking, it’s easier to get yourself into this conundrum than you might imagine.

My debt, my problem

No matter how committed I am to a relationship, I firmly believe adults need to resolve their own problems.

Although Direct Line found 460,000 of those with partners in debt wouldn’t have started the relationship if they’d known about their significant other’s money woes, I wasn’t really concerned about this.

I was more worried he’d offer to help with my predicament.

If I’ve amassed debts, it’s my responsibility to pay them off – not my boyfriend’s.

The situation isn’t as dire as it sounds

While my debts are higher than I’d like, I make all the repayments on time, stick to a tight budget and have a clear plan to get my finances back in the black.

“No point worrying other people with a situation that’s under control.” At least that’s how I justified my reticence.

I also make a distinction between good and bad debt and some of my debts feel like more of an investment in future career options.

A large part of my £10,000 borrowing is taken up by student loans and money I’ve borrowed to fund equipment for my freelance career: justifiable debts.

Is it even any of his business?

At the beginning of our relationship, I had no intention of pouring over my finances with someone I’d just met.

But at what point does your partner have the right to know about financial factors that could affect your future together?

For some, the answer is unequivocal: “never”.

Shockingly, almost 40% of married Brits who are in debt believe their finances are none of their partner’s business, according to Direct Line.

Perhaps I didn’t “hide” my debts. Maybe I just kept my business to myself.

All I know is that when I confessed to my boyfriend, he was clearly hurt I hadn’t trusted him enough to confide my problems sooner.

It was a low point in our relationship.

We’d talked about everything else: teenage heartbreaks, the deaths of parents, excruciatingly humiliating first dates.

For some reason, the money chat felt like an intimacy too far.

Are you responsible for your partner’s debts?

Being romantically linked to another person doesn’t automatically create a financial relationship, even if you’re married.

In most cases, you’ll only form a financial association if you apply for joint credit or open a current account together.

Unless you’ve undertaken any of these financial arrangements, a creditor can’t chase you for money your partner owes.

There are, however, a couple of exceptions.

If you act as a guarantor on your partner’s debt, for example, your own credit may be damaged if he or she doesn’t pay up.

The benefits of honesty

While some may believe their finances are none of their partner’s business, there are definite advantages to having a frank conversation about money, especially when you’re cohabiting.

This will help you make informed decisions on subjects such as whether to open a joint savings or bank account, how much each partner should pay towards utilities and the amount of life insurance you need (if any).

Learn more about couples and finances

The end of the (financial) affair?

In case you’re wondering, my financial faux pas didn’t inflict any lasting damage on our relationship.

But we could have certainly avoided a few blazing rows and icy stares if I’d been brave enough to face an honest conversation with my beau earlier on.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature