Pension goals: should you set a savings target to ensure a comfortable retirement?

Is setting a target sum for retirement really the best way to maximise savings, or would we be better off 'rolling the dice' and simply saving what we can?

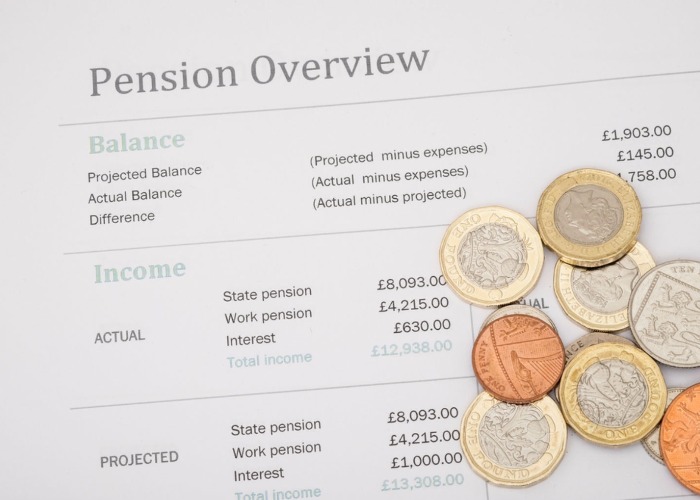

How much do you need to have saved in order to retire?

It’s a common question when it comes to pensions, but it’s one that huge numbers of us are not even attempting to answer, according to a new study.

A report from financial planning firm Sanlam has warned that more than three-quarters of UK adults are “rolling the dice” with their later years, in that they have not set a savings target for their retirement.

But is this really such a bad thing? Is a target that important?

People get motivated in different ways

Sanlam argued that by failing to set a proper target ‒ and following through by actually saving that amount, obviously ‒ it’s a question of luck whether we end up with enough cash set aside to cover us once we pack up work.

Interestingly, this isn’t just a case of young people leaving the worrying about pensions for another day.

The report found that less than one in five (18%) of those aged 45-55 ‒ who you might imagine have at least one eye on how they are going to get by in retirement ‒ have a set retirement goal.

There’s a gender gap at play here too, with just 18% of women putting a plan in place, compared to almost a third (29%) of men.

Given women are already having to battle against the gender pay gap, Sanlam said the lack of planning from female savers is even more concerning.

Setting a target is all well and good if you’re the sort of person that’s motivated by targets.

Yet Sanlam’s study found that around two-fifths of us (39%) don’t see setting targets as particularly important when it comes to financial planning, which is obviously a big factor in the almost complete lack of them among savers.

Capital at risk

How much is really enough for you?

All of which leads to the obvious question: what difference does a target make?

It’s easy to view the lack of a hard pension target as a sign that people aren’t engaged with their pension saving, putting it off as something to worry about at some indeterminate point in the future.

And I have no doubt there are plenty of people for whom that’s absolutely the case.

But I also think it’s open to debate just how useful a pension target really is.

Sure, some pension experts advise putting enough aside to ensure that you have an income of around two-thirds of your normal salary in retirement, but that’s only a guide.

We don’t really know how much we will need in retirement, given that for some of us it’s the best part of four decades away.

And then you have to account for the sharply different needs we may all have in retirement ‒ not everyone will need expensive care services, for example, while chances are plenty of us will have a decent amount of housing equity to tap into to supplement the amounts we actually save.

I’m very much a person that is motivated by targets, yet even I think setting a pension target itself is a massive shot in the dark.

Save what you can

Rather than set an arbitrary target, and then punish yourself for not hitting it, it’s arguably more productive to stick with the mindset of saving as much as you can.

The auto-enrolment scheme has been a brilliant success in that it’s getting more of us saving into a pension, and with those contributions topped up by cash from our employers.

And even though the minimum contributions have been cranked up, rising from 3% of an employee’s gross salary to 5% back in April, there’s no question that sticking to those minimums isn’t going to be enough for most of us.

So contributing more than that, where possible, is a positive change that we can make and which will make a difference to our overall position in retirement, without the guilt that comes from failing to hit a random target.

Indeed, just making the most of every pension perk you can is important.

So if you aren’t already signed up to your workplace pension scheme, make sure you do ‒ that extra cash from your employer will go a long way once you pack in work.

And if you’re self-employed like me, while you can’t join a workplace pension scheme, you can still enjoy tax relief on your contributions.

Stats from the Government suggest that while almost five million people are now working for themselves, a paltry 14% are saving into a pension of some sort.

That’s far more terrifying to me than the lack of savers having an actual target for their pension pot. They aren’t so much rolling the dice as sticking their heads in the sand.

What do you think? Will a retirement savings target encourage people to save more, or simply set people up to fail? Let us know your thoughts in the comments section below.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature