Coronavirus money dos and don'ts: mortgage, benefits, bills, pensions, & more

There are plenty of things you should – and shouldn't – do right now to improve your finances.

It’s a nerve-wracking time for all of us. And when things get a bit stressful, it can be easy to make all sorts of costly mistakes with your money.

So what should you absolutely be doing at the moment to get the most out of your cash? And what should you avoid?

Here are the financial dos and don'ts during the pandemic.

Do: slash your bills

Plenty of people put off shopping around for new deals for a host of household bills, whether that’s for energy, broadband or mobile phones, simply because they don’t feel they have the time.

Well, there’s no such excuse anymore. What’s more, now is a crucial time to ensure you are paying as little for your household bills, given many of us are going to be relying on these services even more than usual.

After all, we are all spending more time at home, so that inevitably means greater use of gas and electricity. Shopping around for a new deal only takes 10 minutes or so, but has the potential to save you hundreds each year.

Compare energy deals with loveMONEY

It’s a similar story with things like broadband, given so many of us are reliant on it in order to work or to entertain ourselves by streaming TV shows or music.

Now is the perfect chance to compare deals, ensure our package covers the amount of data we actually need, and that it is competitively priced.

Do: talk to your mortgage lender

The biggest monthly bill for most of us to deal with is the mortgage, and so it merits extra consideration when it comes to managing your money currently.

If your income has completely dried up and you’re unsure about making your normal repayments, speak to your lender as a matter of urgency.

Lenders across the board have agreed to offer borrowers three-month mortgage payment holidays if needed, which could provide a bit of badly needed breathing space.

Be warned though, this is just a holiday ‒ they aren’t cancelling those payments entirely, merely deferring them for a while.

As a result, a mortgage holiday will mean your mortgage ends up costing a little more overall to pay off, so it’s definitely not something you should take up unless you need it.

It’s a good idea to explore your options if you’re on your lender’s Standard Variable Rate (SVR) ‒ the rate you move onto when your fixed deal finishes ‒ as they are usually more costly than going for a new fixed deal.

Similarly, if you are approaching the end of a fixed deal, then it makes sense to do some homework now.

That said, the market is changing incredibly quickly, with lenders shuffling their product ranges, so it may be worth enlisting the help of a mortgage broker.

Don't: panic sell your investments

I made the mistake of having a look at the state of my investments last week.

It’s one thing to read headlines about the sharp falls taking place on the world’s stock markets, but seeing its effects on the size of your pot ‒ or what used to be a pot and is now more a collection of coins ‒ was pretty shocking.

Seeing a sea of red, with funds and stocks alike dropping in value, can make investors feel they need to do something to stem the tide, for example selling off the worst offenders.

But in truth, this may not be a great idea. Investment, after all, is a long-term activity and while things are seriously rocky right now, over time you may end up better off holding your nerve.

Indeed, some investors see the current situation as presenting an opportunity to pick up some valuable stocks on the cheap, with the idea that they will be worth far more once the recovery really kicks in.

View your investment options with loveMONEY (capital at risk)

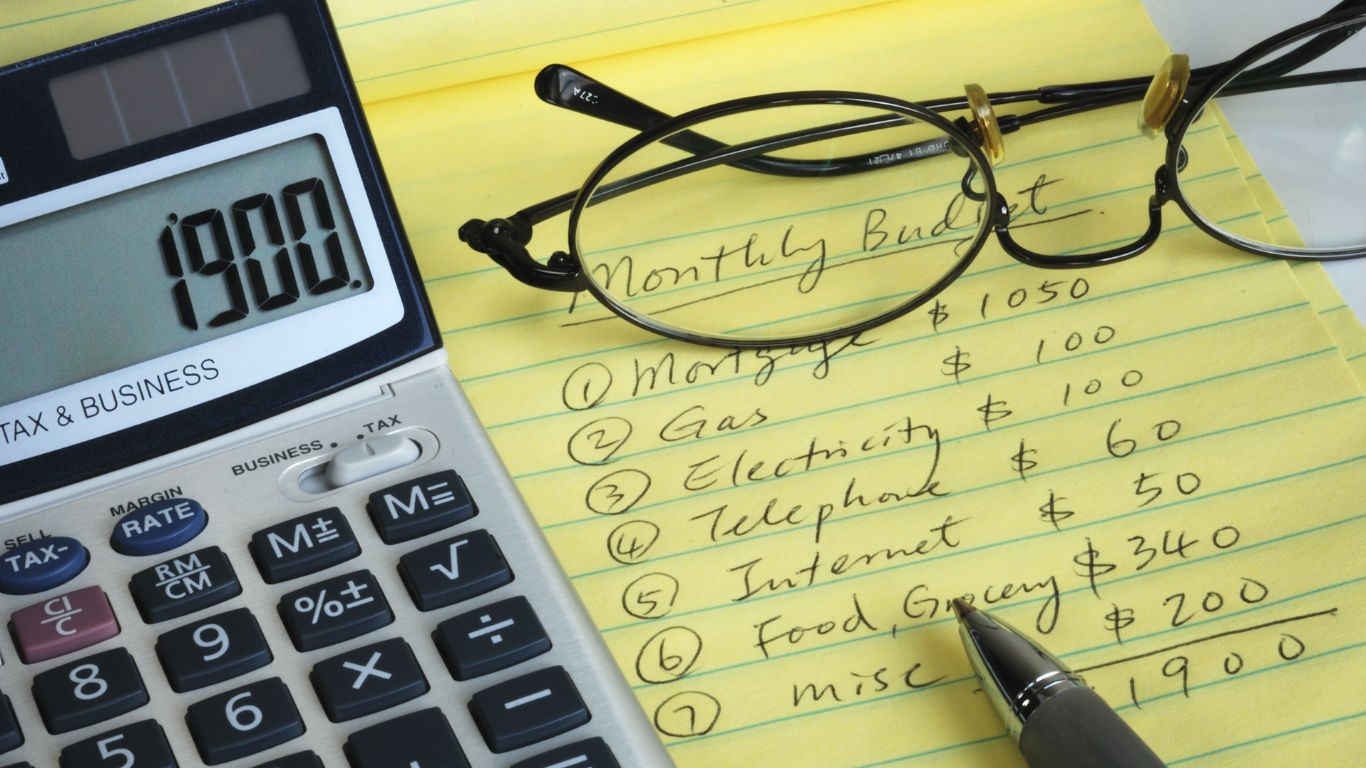

Do: get budgeting

Trimming your household bills is only one part of getting your money position into better shape.

You will also want to go through your finances to see precisely where your money is going each month, and whether there’s a chance to reduce that.

For example, if you have a monthly subscription for something you are no longer using ‒ perhaps a gym membership ‒ then it’s a good idea to contact the provider to see if you can pause that membership, saving you a few extra pounds.

This is even more important given plenty of people are having to make do with smaller incomes as a result of the Coronavirus pandemic.

Do: check what help you can get

There is enormous uncertainty among people about precisely how much money is going to be coming in each month ‒ and where it is actually coming from.

If you’re employed, it’s a good idea to speak to your employer so that you understand how they are handling payroll and what you will be getting each month.

Equally, it’s a good idea to check whether you are entitled to help from the Government.

The Turn2us charity is an excellent place to start, with its various benefit calculators and resources.

Take the pain out of saving: manage all your accounts in one place with Raisin

Don't: touch your pension!

When the pension freedoms were brought in a few years back, they gave people over the age of 55 far greater control over precisely what happens with their pension cash, and how they can get hold of that money.

And the current uncertainty may make it awfully tempting to dib in just a little, to get hold of some of that pension cash, whether because of the volatility on the stock markets or to top up your bank account.

Where possible, this should generally be avoided though. There are already concerns that people are withdrawing cash from their pensions too quickly, increasing the risks of ending up penniless in our old age.

If you keep that money invested, it has the potential to grow in value over time, but you give up on that potential by withdrawing it now.

If you are unfortunate enough to be retiring in the midst of this chaos, talk to your company about the possibility of working a little longer, even part-time.

As Wealth At Work, a financial education and guidance provider, explains: "There is every chance that everything will look very different in a few months’ time.

"If you are able to delay your retirement, it may be worth considering this. It would give some time for markets to hopefully recover, and give you more confidence in leaving the workforce."

If this isn't an option, the firm suggests tapping into any savings you have first.

"There are many assets such as Cash ISAs and general savings, which can be used as potential sources of income in addition to your pensions.

"If you want to give your pension some time to recover, you might want to use these other savings first."

Take the pain out of saving: manage all your accounts in one place with Raisin

*This article contains affiliate links, which means we may receive a commission on any sales of products or services we write about. This article was written completely independently.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature