How will the biggest and richest economies fare in 2025?

How will the world's major economies perform next year?

The world economy is in reasonable shape and should remain so for the year ahead, according to the OECD. In the latest interim update to its Economic Outlook, the Paris-based organisation says global activity was resilient in 2024 and should stabilise at current levels. Trade volumes are recovering despite consumer confidence staying weak, and wages are robust even as the labour market cools. Meanwhile, headline inflation has reached target in half the advanced economies and more than half of developing countries.

However, that doesn’t mean every country is thriving.

Read on to discover how 25 countries, including all of the G20 group, are expected to perform in 2025, ranked in terms of their projected growth from worst to best.

Germany: 0.7% growth

At just 0.7%, Germany’s growth will be the slowest of any major developed economy in 2025. The OECD has even knocked 0.3% off the uninspiring figure it gave in its last interim forecast, published in September. And this new, lower increase will follow zero growth in 2024.

The OECD has singled Germany out as notable for its weak industrial activity. Uncertainty over support for green projects and potential supply chain disruption due to the volatile situation in the Middle East continue to pose significant risks. Overshadowing everything is the governing coalition’s collapse and the resulting elections in 2025, which bring considerable political uncertainty.

Italy: 0.9% growth

Italy is expected to outperform Germany in 2025 – but only just. At 0.9%, its growth will also rise above 2024's meagre 0.5%. Looking further ahead, 2026 will bring a slightly better 1.2% extra GDP. Steadily growing wages, investments related to the national COVID-19 recovery fund, and an upswing in exports are expected to offset the nation's economic challenges to some extent.

One risk is a potential contraction in housing investment due to the scaling back of the 'Superbonus' tax credit, which enabled residents to claim tax credits against the cost of qualifying home renovations. And Italy has plenty of other growth obstacles to contend with, including high interest rates and staggering government debt, which is expected to cost no less than 4% of GDP in interest payments in 2025.

Sponsored Content

France: 0.9% growth

France is facing political turbulence, with Prime Minister Michel Barnier losing a no-confidence vote in December. He's been replaced by François Bayrou - the country's fourth premier in a year. The OECD has downgraded its 2025 economic forecast for France by 0.3% since September. Underpinning its projection for very modest economic growth is falling inflation and a moderate recovery in foreign demand, which should stimulate consumer spending and exports. The services sector also enjoyed a brief upswing from Paris hosting the Olympics.

Like Italy, France has racked up massive public debt and it has a persistent annual deficit. Getting these down is among its biggest challenges, and some painful fiscal consolidation could be on the cards in the future – whoever leads the government. Just hours after Bayrou was appointed, the credit ratings agency Moody's downgraded France's credit rating.

Russia: 1.1% growth

Beleaguered by its invasion of Ukraine and with economic sanctions biting, some might wonder how Russia is predicted to have any growth at all. The OECD figure is not large, and it’s substantially less than the 3.9% growth that 2024 mustered - though a bit more than the 0.9% expected in 2026. However, all's not quite what it seems.

Russia’s economy appears to defy expectations, but the headline figures don’t mean good times for most Russians. The lion’s share of growth is down to government spending on the war, and that’s boosting inflation, which is currently around the 8% mark. The rouble has lost value and the Central Bank has hiked interest rates to 21% - the highest level in over 20 years. Meanwhile, the cost of living is spiking, with even essentials such as butter rising in price.

It's as if there are two economies in Russia right now: the war economy and the situation for everyone else. Businesses serving the military are enjoying government subsidies and other support. Those who don't are suffering, and the non-war economy may even tip into recession.

Austria: 1.1% growth

Austria's 2025 growth prediction will be a relief: its economy took an almighty battering in 2023 when it shrank by 0.7%, and with another contraction of 0.5% for 2024, the projected figure for 2025 may be modest, but it’s nevertheless something to celebrate.

Softening inflation and interest rates, coupled with increased external demand, will be the primary growth boosters. On the downside, private investment will likely stay muted in 2025, while any major disruption to global trade could rain on Austria's recovery parade.

Sponsored Content

Mexico: 1.2% growth

Mexico's economy is projected to expand by 1.2% in 2025, though this will be a significant drop from the 2% that the OECD had expected to see in its May 2024 forecast and less than the 1.4% predicted for 2024.

Private consumption, supported by historically low unemployment and increasing real household incomes, will be the crucial catalyst for growth. However, domestic demand has slowed somewhat. Mexico hopes to benefit from nearshoring as a growing number of major US firms move their manufacturing out of China. But the election of Donald Trump as president might hinder that – he’s spoken of putting high tariffs on goods from his North American neighbours.

Other economic party poopers, including services inflation, could end up spoiling the fiesta and dampening growth in the worst-case scenario. Claudia Sheinbaum (pictured) is now the country’s first female president, having won a landslide election victory in 2024.

New Zealand: 1.4% growth

New Zealand's economy is set to grow by 1.4%, according to the OECD. As is the case in most countries, inflation is falling, so you might think things are reasonably positive. However, significant challenges stand in the way of progress.

The central Bank has been cutting interest rates to try and stave off a downturn, yet it still says a second recession in two years may be on the cards for the final quarter of 2024. Retail sales have fallen along with some goods exports, meaning the current account is in deficit. Meanwhile, the nation's housing market is under a lot of strain.

Other risk factors include the possible global trade disruption should the conflict in the Middle East escalate again or China's economy fare worse than expected (China is New Zealand's biggest trading partner). Before any upturn, New Zealand will endure some economic headwinds.

Japan: 1.5% growth

The latest 2025 growth forecast for Japan is a 0.1% upgrade on the last interim figure. The projection for 1.5% is an improvement on this year's disappointing contraction of 0.3% amid temporary supply chain disruptions.

Rising wages, fiscal stimulus, and increased corporate investments are all bolstering the nation's economy as private consumption and business activity increase. Inflation is set to fall, and its effects should be tempered by the Bank of Japan's decision in 2024 to abandon its long-standing negative interest rate policy.

Sponsored Content

South Africa: 1.5% growth

South Africa's growth forecast for 2025 has also nudged up by 0.1%, and it will improve on 2024's 1.0%. The nation has several economic hurdles to overcome, including reducing its hefty public debt and current account deficit to sustainable levels, along with a rise in its already-high rate of unemployment. Even so, its general financial situation is markedly improving, with exports and consumer spending on the up.

The power shortages and supply-chain bottlenecks that have plagued the country are finally easing. Inflation is falling, and in September, the central bank made its first interest rate cut in more than four years. At the same time, real wages are climbing, and a pension reform rolled out in 2024 will hopefully put more money in retirees' pockets.

Netherlands: 1.6% growth

The OECD is cautious about Dutch growth prospects for 2025. At 1.6%, the economy will outstrip 2024’s lacklustre 0.9% and it’s expected to stay at the same rate into 2026. Private consumption will be the principal growth engine as rising wages and easing inflation both boost spending.

Nevertheless, inflation is falling at a slower rate than in other EU nations, partially due to a tight labour market. Another potential complication is the possibility of widespread supply chain disruption due to the conflict in the Middle East as the Dutch economy is particularly “sensitive to global trade developments”, according to the OECD.

The Dutch economy may be moving in the right direction, but it won’t set pulses racing just yet.

UK: 1.7% growth

The OECD has upgraded Britain’s forecast since May, when it was at the bottom of the growth rankings. It now expects 2025 to bring growth of 1.7%. Strong wage gains and factors including a cut in employees’ national insurance are at work here. Even so, Britain’s economic mood is low.

The OECD expects the UK to have the highest inflation rate in the G7, and services inflation in particular remains stubbornly high. Meanwhile, after a controversial government budget in October, investment is stagnant, and the tax burden remains at its heaviest in 70 years. The new Labour government has made growth one of its priorities, but this is proving difficult to achieve. The country's own statistics show zero growth in the third quarter of 2024, putting Britain on recession watch.

Sponsored Content

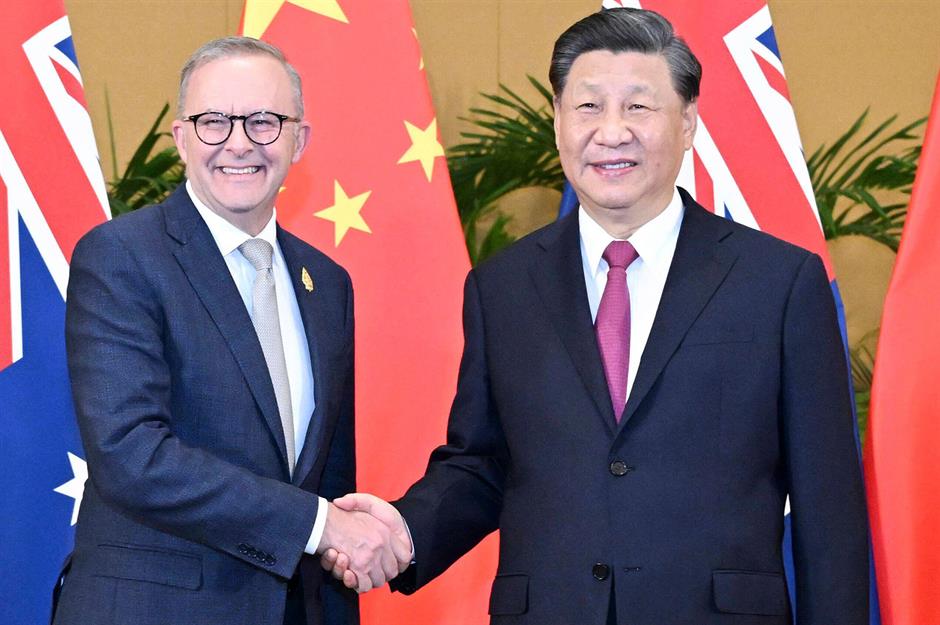

Australia: 1.9% growth

Australia's growth prediction for 2025 has been downgraded since May by 0.3% though this will still represent a significant increase from the 1.1% figure expected for 2024. We’ll have to wait until 2026 for more reassuring growth of 2.5% Down Under.

High interest rates will dampen household spending, says the OECD, though it thinks strong population growth and higher exports will partly compensate for this. The problem is inflation, especially services inflation, which is holding back interest rate cuts. Meanwhile, unemployment is projected to rise. Being a major commodities exporter, Australia also faces the risk of being adversely affected by a slowdown in China or large-scale disruption to global trade.

Canada: 2.0% growth

Canada's growth figure for 2025 has moved up from the 1.8% predicted in September’s interim outlook, and it should now reach 2% and stay at this level into 2026.

Inflation has been brought down to 2.4% and is expected to fall further. The country's central bank has led the way on interest rate cuts, with more expected to follow. Legal immigration, which has climbed to its highest level since the 1950s, is helping to pep up private consumption and the labour market. Meanwhile, wages are growing, and although they have yet to recover their pre-pandemic levels, they should help workers to regain some of their lost purchasing power.

South Korea: 2.1% growth

South Korea is forecast to see growth of 2.1% in 2025 – slightly less than the final figure expected for 2024. Exports, particularly of semiconductors, are rebounding due to stronger global demand, while private consumption and investment will recover as interest rates fall. Inflation has cooled more than expected and even fallen below the target figure.

On the downside, international geopolitical tensions – which could throw South Korea's supply chains into disarray and fuel inflation – represent a risk for the nation's economy. And turmoil at home caused by President Yoon's impeachment could also impact growth.

Sponsored Content

Brazil: 2.3% growth

The OECD has dampened Brazil's 2025 growth forecast a little and it now stands at 2.3%. With year-on-year inflation forecast to ease, it hopes business investment will bounce back. Meanwhile private consumption – the main growth driver – will remain strong, anchored by jobs growth and minimum wage hikes.

However, a severe disruption to global trade thanks to possible US tariffs, slower growth in China (a key export partner for Brazil), and a worse-than-anticipated fiscal balance all have the potential to undermine the country's growth. In September, Brazil’s Central Bank raised interest rates for the first time in two years, and it has continued tightening its monetary policy.

Spain: 2.3% growth

Spain's 2.3% growth forecast for 2025 is slightly improved from September’s 2.2% figure. With the ideal GDP growth rate for a developed economy supposedly between 2% and 3%, the country will be sitting on the sweet spot over the next 12 months. Although growth will be less than the impressive 3% now expected for 2024, it remains resilient and will lead the major European economies. Moreover, British magazine The Economist named Spain the best economy in the world for 2024.

Inflation is dropping in Spain and is expected to dip to 2.1% in 2025. Meanwhile, real wages are rising, and unemployment – though high – continues to fall. Investment is poised to pick up as the Spanish government implements its COVID-19 recovery plan, and exports are expected to increase, too. But it's worth noting this growth could be harmed by factors such as major global trade disruption or a slower implementation of the recovery plan.

USA: 2.4% growth

The United States is about to have a new administration under Donald Trump and until we know for sure how it will apply trade and economic policy, uncertainties about the future abound. That said, the OECD sees 2025 bringing a healthy 2.4% growth, even if it will be nearly half a percentage point down from the impressive 2.8% of 2024.

The cooling might well be cushioned by monetary policy easing. In November, the US Central Bank lowered interest rates for the second time in four years and this, along with easing inflation and strong productivity gains, will buttress investment and spending.

Geopolitical tensions, an intensifying trade war with China or supply chain disruption due to the Middle East conflict could nevertheless weigh heavily on the US economy in 2025.

Sponsored Content

Türkiye: 2.6% growth

Türkiye's OECD growth forecast for 2025 is half a percent down from the last interim prediction. At 2.6% it still looks pretty good, but don't let that fool you into thinking the Turkish economy is doing well.

Exports and tourism receipts are up, but inflation has been extremely high, and though expected to fall in 2025, it will still be over 30%. Meanwhile, unemployment is projected to remain a problem. While reconstruction following 2023's devastating earthquake in southern and central Türkiye is bolstering the national economy, it's also pushing the deficit higher, meaning severe fiscal tightening is on the horizon.

The biggest challenge of all is taming that inflation. Very high interest rates are punishing businesses and households, and the country's economic growth has slowed to the weakest pace since the COVID-19 pandemic.

Colombia: 2.7% growth

Colombia's 2025 growth figure will be 2.7% which represents solid progress on top of 2024's 1.8%. Inflation has been high at 6.7%, according to the OECD. Yet it is expected to ease considerably, hitting 4.3% in 2025 and a far more manageable 3.1% the year after. This, in turn, can enable a loosening of interest rates, stimulating business investment.

As real incomes grow, private consumption will expand, supported by significant remittances from Colombians working overseas. A projected moderate increase in exports also adds to the good news.

Saudi Arabia: 3.6% growth

Saudi Arabia’s growth is expected to surge by over two and a half percentage points more than 2024's 1% figure. With inflation expected to stay well under 2%, there's plenty for the Desert Kingdom to be optimistic about.

The Saudis are eager to diversify beyond oil production, and to that end, they're implementing the ambitious 'Vision 2030' strategy to make the country a global destination for investment in technology, tourism, and renewable energy. The idea is that this kind of activity will be less volatile than an economy based on hydrocarbons.

It entails an enormous investment, and the government expects to run a deficit as it pours money into schemes like the Neom megaproject. At the same time, oil is providing less income. It's a huge gamble, but if all goes according to plan and this kind of robust growth continues, the Saudis could soon have one of the top-performing economies in the Middle East.

Sponsored Content

Argentina: 3.6% growth

Argentina has been mired in recession, and the OECD expected its economy to shrink by 3.8% across the whole of 2024. Yet the contraction ended in the third quarter, and 2025 looks set to continue the improvement with a positive growth figure almost the mirror image of the previous negative one.

Argentinians are feeling the pain of over 100% inflation and President Javier Milei's economic 'shock therapy', though the OECD describes his wave of austerity as "considerable but necessary". It expects inflation to ease in 2025 (though it will still be almost 30%) and economic restrictions to gradually lift. A rise in real wages is predicted, and business investment should also increase. This will propel growth into positive territory. But Argentina has a long way to go to achieve a healthy, vibrant economy that works for its people.

Ireland: 3.7% growth

Ireland's enviable 3.7% growth will eclipse a small contraction in 2024, but in this small country with some big economic numbers, things aren’t always as they seem.

Its headline GDP is skewed by the large number of multinationals that report their global incomes there. It includes money that does not stay in the country. A downturn in this sector is the main reason for the current disappointing figure, and it also largely explains the bounce back.

To better understand how the domestic economy is doing, economists look to an indicator called Modified Domestic Demand (MDD) rather than GDP. The Irish government now predicts MDD to grow by 2.5% in 2024 and 2.9% in 2025 as modest inflation, a solid labour market, and other tailwinds boost business investment and consumer spending.

China: 4.7% growth

The OECD has edged China's growth forecast for 2025 up slightly compared to its last interim outlook. It will stand at 4.7%, just a touch down from 2024’s 4.9% achievement. It’s growth that many countries would envy, but China’s situation is nevertheless complex and challenging. Policies aimed at stimulating the economy, such as infrastructure spending, are being offset by a property market crisis and weak consumer demand. High youth unemployment is also hampering growth. On the plus side, an increase in industrial production and growing demand for Chinese exports have improved economic prospects.

With all this in mind, the 4.7% figure is actually modest compared to the very high annualised growth that China reported in the late 2010s. Geopolitical tensions with the West could also cast a shadow over the economy, especially if Beijing flexes its military muscle in the Taiwan Strait.

Sponsored Content

Indonesia: 5.2% growth

At 5.2%, Indonesia's growth forecast for 2025 also remains unchanged in the latest interim Economic Outlook. The OECD describes domestic demand as solid and says consumer confidence is improving. Inflation is expected to fall to within the government target of 2.5%, and with this in mind, the central bank has made its first cut in interest rates since early 2021.

Although demand for Indonesia's exports should remain strong, reduced prices for its key commodities such as coal and palm oil will make for lower nominal export growth, creating a small trade deficit. Vulnerabilities are centred around the potential for global supply chain disruption since the Indonesian economy relies heavily on exports.

India: 6.9% growth

The fastest-growing major economy, India's output is expected to expand by no less than 6.9% in 2025. This comes on top of almost the exact same level of growth predicted for 2024, and for 2026. The governor of India’s central bank has suggested sustainable growth of up to 8% in the coming years is a possibility.

The driving forces of India's growth include comprehensive public investment in infrastructure and other areas, healthy business investment, and blossoming exports, from tech products to IT and consulting services. There's a catch though: while inflation and interest rates are predicted to ease, private consumption is set to be lacklustre in 2025.

Now discover how wealthy the average person is in 25 countries around the world

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature